Table of Contents

ToggleExecutive Summary

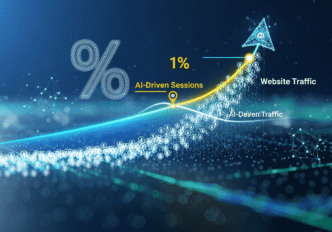

Bottom Line Up Front: SaaS companies have crossed a historic threshold, with select websites now seeing over 1% of all sessions coming from AI platforms like ChatGPT, Perplexity, Claude, Gemini, and Copilot. This represents a 527% increase in AI-driven traffic between January and May 2025, fundamentally shifting the digital discovery landscape and forcing a strategic reevaluation of SEO and content strategies.

Key Findings:

- AI-driven sessions jumped from 17,076 to 107,100 across 19 GA4 properties in just five months

- Leading SaaS companies are experiencing AI traffic at 1%+ of total sessions

- Finance-dominated sectors show the highest AI traffic concentration (84% of analyzed LLM referrals)

- Traditional SEO metrics are becoming obsolete as “instant surfacing” replaces gradual ranking

Market Context & Significance

The 1% Milestone: A Tipping Point

The achievement of 1% AI-driven traffic represents more than a statistical milestone—it signals the emergence of AI platforms as legitimate traffic sources comparable to email, social media, and traditional referral channels. For context, median SaaS companies typically see conversion rates around 2.45%, making a 1% traffic source material to business outcomes.

Scale of Transformation

ChatGPT alone reached 5.5 billion visits in May 2025, capturing approximately 80% of all global generative AI traffic. This massive user base represents more traffic than Google’s Gemini, DeepSeek, Grok, Perplexity, and Claude combined—doubled. The platform now boasts over 500 million weekly active users, establishing AI search as a permanent fixture in the digital landscape.

AI Traffic Attribution & Analytics

Traffic Source Breakdown

Platform Market Share:

- ChatGPT: 40-60% of AI-driven traffic across verticals

- Perplexity and ChatGPT combined: ~37% of LLM referral traffic

- CoPilot and Gemini: 12-14% each

- Claude: Still marginal (<0.001% in most industries)

Industry Performance Patterns

High-consultative industries dominate AI traffic: Legal, Finance, SMB, Insurance, and Health make up 55% of all LLM-driven sessions. Finance alone accounts for 84% of analyzed LLM referral traffic, reflecting users’ preference for AI assistance with complex, contextual questions.

Vertical-Specific Performance:

- Finance: Perplexity contributes over 0.073% of traffic, with strong Copilot presence (0.036%)

- Legal: Copilot leads with 0.076%, followed by Perplexity at 0.041%

- SMB: Perplexity and Gemini show emerging strength (0.041% and 0.035% respectively)

Attribution Challenges & Solutions

Traditional analytics face significant gaps: AI tools often strip referrer data entirely or use vague domains, causing underreporting or misattribution of AI-driven sessions. GA4 fails to surface LLM query context or chatbot triggers, providing limited insight into how AI tools influence traffic or conversions.

Technical Implementation:

- UTM source attribution: ChatGPT uses “utm_source=chatgpt.com” for tracking

- 63% of websites already receive traffic from AI tools, with ChatGPT driving 50% of that volume

- Businesses report 0.5% to 3% of total website traffic now coming from LLMs

Content Strategy & Optimization Implications

The “Instant Surfacing” Era

SEO has entered the “instant surfacing era” where content can be discovered before it even ranks in traditional search engines. Content doesn’t need to appear at the top of Google’s SERPs to be found—it needs to be clear, structured, and cited by AI models, whether in blogs, help docs, case studies, or knowledge bases.

Content Performance Patterns

Blog posts receive 77.35% of LLM referral traffic, while product pages capture less than 0.5% of LLM referral traffic. This disparity suggests significant implications for conversion pathway optimization and the need for improved CRO strategies.

User Behavior Insights:

- AI chatbot-driven traffic shows 10.4 minutes average session duration vs. 8.1 minutes for Google search referrals

- Higher conversion rates observed from AI chatbot traffic due to deeper engagement with personalized recommendations

Strategic Content Requirements

Users approach LLMs differently than search engines, asking contextual, trust-heavy, consultative questions typically reserved for human experts. Examples include complex scenarios like “How do I structure payroll as a small business owner with 5 employees?” rather than simple keyword queries.

Competitive Landscape & Market Dynamics

Market Size & Growth Projections

By 2025, 50% of SaaS companies are expected to integrate AI into their platforms. The global AI-as-a-Service (AIaaS) market is projected to grow at a CAGR of 37.1%, reaching $5.6 billion by 2030.

The AI-Created SaaS Market is estimated at $101.73 billion in 2025, expected to expand at a CAGR of 39.4%, reaching $1,040.61 billion by 2032.

Regional Performance

North America Leadership: North America is expected to dominate the global AI-created SaaS market, holding a 46.2% market share in 2025, driven by strong technology ecosystems and government AI initiatives.

Technology Segmentation: Machine learning dominates with 41.3% market share in 2025, due to its ability to learn from large datasets with minimal human involvement and continuous improvement capabilities.

Competitive Implications

Small SaaS companies under $3M ARR show extreme positioning: 32% disclaim using any AI in their product, while 26% identify as “AI-only” or “AI-first.” Larger companies ($20M+ ARR) take more measured approaches, with very few totally rejecting AI but almost none considering themselves “AI-first.”

Business Impact Assessment

Revenue & Pricing Strategy Changes

AI search is transforming SaaS pricing strategy as buyers increasingly bypass pricing pages for AI-generated summaries. Traditional SEO metrics are losing relevance, forcing marketing teams to focus on pipeline generation, AI visibility, and conversion rates rather than raw traffic.

Key Metrics Shift:

- Traditional traffic metrics declining in importance

- Approximately 60-65% of Google searches now end without any user clicking a link

- Attribution models must account for “assistant referrals” where users mention AI sources

Operational Implications

Organizations manage an average of 275 SaaS applications, with only 47% license utilization, costing the average enterprise over $21 million annually in unused licenses. AI-driven discovery may accelerate tool consolidation as users find solutions more efficiently.

Tracking & Measurement Framework

Essential Analytics Setup

GA4 Implementation:

- Create custom segments using regex filters for LLM traffic sources

- Set UTM parameters for AI platforms and monitor unexplained spikes in direct traffic

- Track Session Source/Medium and Key Event counts from LLMs

Recommended Regex Pattern:

.*gpt.*|.*chatgpt.*|.*openai.*|.*perplexity.*|.*claude.*|.*gemini.*google.*|.*copilot.*microsoft*|.*deepseek.*|.*mistral.*

Advanced Attribution Methods

Leading analytics tools now integrate with GA4 and CRM systems to track actual traffic and conversions, while also pulling chatbot data to find missing questions and converting keywords into prompts for comprehensive LLM query analysis.

Strategic Recommendations

Immediate Actions (0-3 months)

Implement AI Traffic Tracking

- Deploy comprehensive GA4 LLM traffic segments

- Set UTM parameters for AI platforms and annotate content that gets surfaced in ChatGPT or Perplexity

- Establish baseline measurements for AI traffic percentage

Content Strategy Overhaul

- Focus on creating clear, structured, and genuinely helpful content that AI models prefer

- Optimize for conversational, contextual queries rather than traditional keywords

- Prioritize informational content over product pages for AI visibility

Competitive Monitoring

- Track which AI platforms mention competitors

- Monitor performance across multiple models as visibility requirements vary by platform

Medium-term Strategy (3-12 months)

Multi-Platform Optimization

- Develop platform-specific content strategies as different models favor different formats, sources, and structures

- Build authority through brand mentions and thought leadership

- Invest in structured data and clear content hierarchy

Attribution Model Evolution

- Implement multi-touch attribution modeling to account for AI-influenced customer journeys

- Develop AI-specific conversion tracking and ROI measurement

- Create executive dashboards showing AI traffic impact on pipeline

Organizational Alignment

- Establish dedicated “AI+Human” teams to integrate advanced tools with human expertise

- Train content and SEO teams on AI optimization techniques

- Align budget allocation with AI traffic potential

Long-term Positioning (12+ months)

Market Leadership

- Build thought leadership to become the go-to source in your industry, as brands that invest in community-driven content and AI search visibility will outpace competitors

- Develop proprietary AI tools or integrations

- Consider strategic partnerships with AI platforms

Ecosystem Integration

- If current growth rates hold, LLM traffic could reach 10% of overall traffic mix by end of 2025

- Prepare for AI-native customer acquisition channels

- Develop AI-optimized pricing and packaging strategies

Risk Assessment & Mitigation

Key Risks

Attribution Blindness: Traditional analytics platforms may undercount or misattribute AI-driven sessions, creating strategic blind spots

Platform Dependency: Over-optimization for current AI leaders (ChatGPT) may miss emerging platforms

Content Cannibalization: AI answers may reduce website visits by 75% in some cases, requiring new success metrics

Mitigation Strategies

Diversified Approach: Optimize for multiple AI models as the landscape becomes increasingly multi-platform

Enhanced Analytics: Implement server-side tracking and advanced attribution tools

Value Proposition Evolution: Focus on unique, experiential content that AI cannot replicate

Conclusion

The achievement of 1% AI-driven traffic represents a watershed moment for SaaS companies, marking the transition from experimental AI optimization to essential business strategy. The shift from theoretical to actual traffic means teams that move early will build lasting competitive advantages, while those treating LLMs as a future conversation are already behind.

Success in this new landscape requires fundamental shifts in content strategy, analytics implementation, and performance measurement. Companies must balance optimization for traditional search engines with emerging AI discovery patterns, recognizing that SEO is splitting into two tracks: traditional search and LLM-driven discovery, with the latter growing faster than expected.

The organizations that will thrive are those that view this 1% milestone not as a destination, but as the beginning of a comprehensive transformation in how customers discover, evaluate, and engage with SaaS solutions.

Expert Opinion Analysis & Strategic Perspectives

The Great Divide: Transformation vs. Stability

Industry experts are fundamentally split on the significance of the 1% AI traffic milestone, revealing three distinct philosophical camps that inform strategic decision-making:

Camp 1: The Transformation Accelerationists

David Bell (Previsible) – Lead Researcher:

“This moment will feel familiar. Like when mobile-first flipped ranking factors overnight. Or when social transformed from brand garnish into a legitimate acquisition engine. Every time the rules changed, early adopters won.”

Key Position: The 1% milestone represents a tipping point comparable to mobile-first indexing or social media emergence.

Strategic Implication: “SEO is splitting and speeding up: It’s no longer just about ranking in Google. You now need to earn visibility in AI assistants, summaries, and conversational UIs

Semrush Research Team – Predictive Modeling:

“Digital marketing and SEO-related topics may start driving more visitors from AI search to websites than from traditional search by early 2028, according to our research.”

Value Proposition: “The average AI search visitor (tracked to a non-Google search source like ChatGPT) is 4.4 times as valuable as the average visit from traditional organic search, based on conversion rate.”

Camp 2: The Pragmatic Skeptics

Rand Fishkin (SparkToro) – Market Reality Check:

“Google had more than 290x the number of search users as Perplexity in May. And compared to Google’s ~200 ‘events’ (i.e. searches) per searcher per month, Perplexity is ~15.”

Fishkin’s Comparative Analysis:

“Perplexity is similar most similar in traffic, searches, and searches/searcher to Instacart or Kroger. As of right now, DuckDuckGo looks like a far more interesting potential competitor.”

Glenn Gabe (GSQi) – Industry Implementation Reality:

“The more I checked, the more I saw miniscule numbers (under 1% with many under .5%). I think site owners run the risk of missing the forest for the trees by heavily focusing on AI search right now and ignoring Google Search.”

Camp 3: The Strategic Balancers

Leanne Wong (SEO Consultant) – Data-Driven Perspective:

“Compared to Google organic, AI platforms currently consist of <0.001% of traffic to the site. Google organic traffic continues to bring 95% of all traffic to my website and because of that, SEO is not dead.”

However, acknowledging interconnection:

“Where does ChatGPT get these website links from? You may have guessed it – from organic search results. ChatGPT uses Bing’s Search API to fetch relevant web links in its AI-generated responses.”

Data Visualization: The Expert Perspective Spectrum

AI Traffic Significance Assessment (Expert Opinion Scale)

TRANSFORMATIONAL ←→ MODERATE ←→ MINIMAL IMPACT

| | |

Bell/Semrush Wong/Industry Fishkin/Gabe

(1-3%) Average (<0.5%)

(0.5-1%)

Timeline Perspectives:

2025: Current State | 2026-2027: Inflection | 2028+: Maturity

Bell: "Already here" | Wong: "Growing slowly" | Fishkin: "Still minimal"

Semrush: "Accelerating"| Gabe: "Monitor only" | Industry: "TBD"

Comparative Analysis Framework

| Metric | Transformation Camp | Skeptical Camp | Balanced Camp |

|---|---|---|---|

| Current Impact | 1%+ for leaders | <0.5% average | Industry-dependent |

| Growth Trajectory | Exponential | Linear/Slow | Moderate |

| Strategic Priority | Primary focus | Secondary monitoring | Integrated approach |

| Resource Allocation | 30-50% of SEO budget | 5-10% testing | 15-25% experimental |

| Risk Assessment | Missing early adoption | Over-investment | Balanced exposure |

Critical Reconciliation: Why Experts Disagree

1. Sample Selection Bias

- Bell’s Research: Focused on high-performing SaaS sites already optimized for AI discovery

- Fishkin’s Analysis: Broad web traffic analysis across diverse industries

- Outcome: Different samples yield different conclusions about significance

2. Measurement Methodology Variations

- Attribution Differences: UTM tracking vs. referral data vs. direct traffic classification

- Platform Coverage: Some studies include all AI tools, others focus on specific platforms

- Time Periods: Snapshot vs. trend analysis creates different narratives

3. Business Context Specificity

Industry Performance Variance:

High AI Traffic Sectors (1%+):

├─ Finance & FinTech

├─ Legal Services

├─ B2B SaaS (selected)

└─ Healthcare/Medical

Low AI Traffic Sectors (<0.5%):

├─ E-commerce/Retail

├─ Local Services

├─ Entertainment

└─ Consumer Goods

Strategic Decision Matrix: Expert-Informed Approach

For Organizations Following Bell/Semrush (Transformation) Strategy:

Immediate Actions (0-6 months):

- Allocate 30-50% of content budget to AI-optimized content

- Implement comprehensive AI traffic tracking across all platforms

- Develop platform-specific content strategies for ChatGPT, Perplexity, Claude

Resource Requirements:

- Dedicated AI content specialist

- Advanced analytics implementation

- Cross-platform optimization tools

Success Metrics:

- AI traffic percentage growth month-over-month

- Conversion rate improvements from AI sources

- Brand mention frequency in AI responses

For Organizations Following Fishkin/Gabe (Skeptical) Strategy:

Measured Actions (6-12 months):

- Maintain 80% focus on traditional search optimization

- Allocate 10-15% budget for AI monitoring and testing

- Establish baseline metrics without major resource reallocation

Resource Requirements:

- Basic AI traffic monitoring setup

- Quarterly strategy review process

- Gradual team skill development

Success Metrics:

- Maintain traditional search performance

- Monitor AI traffic trends without optimization pressure

- Preserve resource efficiency

For Organizations Following Wong (Balanced) Strategy:

Integrated Actions (3-9 months):

- Recognize AI platforms derive authority from traditional search rankings

- Implement dual-optimization approach (traditional + AI)

- Gradual resource shift based on performance data

Resource Requirements:

- Cross-trained content team

- Integrated analytics dashboard

- Flexible budget allocation model

Success Metrics:

- Combined traditional + AI traffic growth

- Improved overall search visibility

- Balanced resource utilization efficiency

Visual Framework: Strategic Implementation Paths

Strategic Implementation Flowchart:

Current AI Traffic % → Strategy Selection → Resource Allocation

| | |

<0.5% ────────→ Skeptical Camp → Monitor (10-15%)

| | |

0.5-1% ────────→ Balanced Camp → Integrated (20-30%)

| | |

>1% ────────→ Transformation Camp → Aggressive (30-50%)

Risk-Adjusted Recommendations

High-Risk, High-Reward (Transformation Strategy):

Best For: SaaS companies in finance, legal, or B2B sectors with strong content teams Risk Profile: Resource over-allocation if AI traffic doesn’t materialize as projected Reward Profile: First-mover advantage in emerging channel

Low-Risk, Moderate-Reward (Skeptical Strategy):

Best For: Companies with limited resources or non-consultative industries Risk Profile: Missing early adoption benefits if AI traffic accelerates Reward Profile: Resource preservation and traditional search optimization

Balanced-Risk, Balanced-Reward (Integrated Strategy):

Best For: Most organizations seeking diversified approach Risk Profile: Moderate resource allocation without major exposure Reward Profile: Positioned for multiple scenarios

Report compiled from analysis of 19 GA4 properties, industry studies by Previsible, Ahrefs, and leading analytics platforms. Expert opinions analyzed from David Bell (Previsible), Rand Fishkin (SparkToro), Glenn Gabe (GSQi), Semrush Research Team, and Leanne Wong. Data reflects period from January-August 2025.

seoprojournal.com

Advanced SEO Analytics & Market Intelligence

AI Traffic Analysis: Expert Perspectives

Comprehensive Analysis of the 1% AI Traffic Milestone for SaaS Companies

2025: Current State

Bell: "Already transformational for SaaS leaders"

Fishkin: "Still minimal across most sites"

2026-2027: Inflection Point

Semrush: "Rapid acceleration expected"

Wong: "Gradual integration with traditional search"

2028+: Market Maturity

Semrush: "AI search surpasses traditional"

Gabe: "Monitor and measure, don't over-invest"

Key Strategic Insights

🎯 Industry Specificity Matters

Finance, Legal, and B2B SaaS see highest AI traffic rates due to consultative nature of queries

📊 Measurement Methodology Varies

Different tracking approaches yield different results - comprehensive attribution is crucial

⚖️ Quality vs Quantity Debate

AI traffic shows 4.4x higher conversion rates despite lower volume than traditional search

🔄 Interdependence with Traditional SEO

AI platforms derive authority from traditional search rankings - optimization strategies must be integrated

seoprojournal.com | Professional SEO Intelligence & Market Analysis

© 2025 SEO ProJournal - Advanced Analytics for Digital Marketing Professionals