New research reveals how Google’s AI summaries are relegating traditional search results to digital obscurity, triggering an existential crisis for online publishers

By [News Reporter] | August 16, 2025

The battle for prime digital real estate has taken a devastating turn for online publishers as Google’s AI Overviews systematically push organic search results below the fold, creating what industry experts are calling an “extinction-level event” for content creators who built their businesses on search visibility.

New research reveals that AI Overviews now appear in over 50% of Google searches—doubling from 25% just ten months ago—and are fundamentally restructuring the search results page in ways that make traditional organic listings nearly invisible to users, particularly on mobile devices.

Table of Contents

Toggle

The Spatial Domination of AI Overviews

The crisis centers on a simple but profound shift in search engine results page (SERP) layout. When an AI Overview is present, the first organic result can be pushed down by over 140% in vertical scroll distance. And in mobile layouts, users often have to scroll through several screens before they even reach the first organic link.

Press Gazette’s landmark investigation found that AI Overviews pushed the first search result down to roughly the equivalent of position five or lower in organic search results. Given that the top organic Google result typically attracts around 40% of clicks according to some research, with clickthroughs declining to around 5% for position five in the search results, this spatial displacement represents a catastrophic loss of visibility.

The phenomenon is particularly acute on mobile devices, where screen real estate is already limited. Industry observers report seeing SERPs where “the full screen above the fold was dominated by ads, followed by a full screen of an AI Overview, before you even get to the rest of the results.”

Publishers Document Catastrophic Traffic Losses

The real-world impact on publishers has been swift and severe, with documented traffic declines ranging from 30% to 90% across different types of content sites.

Major News Organizations Hit Hard:

- For The New York Times, the share of traffic from organic search to the paper’s desktop and mobile sites fell to 36.5% in April 2025, down from 44% three years earlier

- Business Insider recently cut about 21 percent of its staff, in a move Barbara Peng, its chief executive, said was aimed at helping the publication “endure extreme traffic drops outside of our control.” Organic search traffic to its websites declined by 55 percent between April 2022 and April 2025

- News UK revealed that The Sun’s digital offering saw global monthly unique users decline 40% year on year to 80m in September, from 134m a year earlier

Specialized Publishers Face Existential Threats: The impact has been particularly devastating for specialized content creators. The travel blog The Planet D shut down after its traffic dropped 90% following Google’s introduction of AI Overviews, while Chegg, an online education company, reported a 49% decline in non-subscriber traffic in January 2025 compared to the previous year.

One publisher described the new reality starkly: “It is tough,” said an online editor at a major national paper. “We used to average around 1.5 million daily page views. Now, we are lucky to hit 800,000.”

The “Below the Fold” Effect Quantified

Multiple studies have documented the precise mechanisms by which AI Overviews are destroying publisher visibility:

Click-Through Rate Decimation:

- When AI Overviews is present, publishers witness a drop of 47.5% in clickthrough rate on desktop, and 37.7% on mobile

- Sites previously ranked first potentially losing up to 79% of their traffic when results appear below the summary

- Mail Online reported a 56% decrease in CTR when AI Overviews appeared for their top-ranking keywords

Mobile vs. Desktop Disparities: The crisis is particularly acute on mobile devices, where limited screen space makes the “below the fold” effect even more pronounced. Research shows that users spend 57% of their viewing time above the fold, with a sharp decline in attention thereafter, making the spatial displacement caused by AI Overviews particularly damaging.

The Scale of AI Overview Expansion

The rapid expansion of AI Overviews has caught many publishers off guard. According to new data from Advanced Web Ranking, Google’s AI Overviews now appear in more than 50% of all search results, marking a major inflection point in the evolution of search. Just ten months ago, that figure was 25%.

Recent analysis shows the feature appearing in specific contexts that directly target publisher revenue:

- AI summaries show up in nearly 30% of search queries and over 70% of problem-solving ones

- Health-related searches see AI summaries in 55% of queries

- “How to” and informational content—the bread and butter of many publishers—are particularly affected

Publishers Fight Back with Legal Action

Recognizing the existential threat, publishers are pursuing legal remedies. The findings have been submitted as part of a legal complaint to the UK’s competition watchdog Competition and Markets Authority (CMA) about the impact of Google AI Overviews on news publishers.

The News Media Association has been particularly vocal about the threat. CEO Owen Meredith stated: “Google’s stated mission is to ‘organise the world’s information and make it universally accessible’ by sending visitors to websites. Introducing GAI into search and AI Overviews that directly synthesise and present information to the user risks discouraging users from clicking through to the original links, in turn threatening the business model of those who invest in journalism and quality news and information.”

Google’s Response: Quality Over Quantity

Facing mounting criticism, Google has attempted to reframe the narrative around declining traffic. When someone does click on a link from an AI Overview, the clicks are “higher quality,” according to Google, meaning readers stick around on the website longer.

However, this argument has been met with skepticism from industry observers. A Google spokesperson told The Guardian the study was “inaccurate and based on flawed assumptions and analysis”, using outdated estimations and a set of searches that did not represent all the queries that would generate traffic for news websites.

The disconnect between Google’s claims and publisher experiences has created a crisis of trust in the industry.

The Advertising Ecosystem Under Threat

The crisis extends beyond mere traffic numbers to the fundamental economics of digital publishing. For many publishers, online traffic makes up a significant part of their income, mainly through page views and online adverts, which help to compensate for declining print sales and revenue from physical advertising.

As AI Overviews push organic results below the fold, they’re also affecting paid advertising placements. Ads and organic listings are often pushed below the fold, forcing advertisers to rethink how they maintain brand visibility. As AI Overviews dominate Google’s search results, traditional ad placements are being crowded out, which means: Fewer ad slots sitting above the fold.

Publisher Adaptation Strategies

Faced with this existential threat, publishers are scrambling to adapt their strategies:

Content Strategy Pivots: Some publishers are attempting to create content that’s more likely to be featured in AI Overviews while simultaneously developing content that can’t be easily summarized by AI. For The Verge, this new reality means the outlet is doubling down on subscriptions and pushing podcasts and newsletters and making its website more like social media — allowing readers to follow writers and topics.

Direct Audience Relationships: Industry experts emphasize that first party relationships with readers are vital as publishers can no longer rely on search traffic as a primary driver of audience engagement.

Diversification Beyond Google: Publishers are increasingly looking to diversify their traffic sources, recognizing that “Publishers are kind of in a bind because if you want to opt out of AI Overviews, you opt out of Google Search entirely,” as noted by Columbia University’s Klaudia Jaźwińska.

The Mobile-First Crisis

The “below the fold” crisis is particularly acute on mobile devices, which now account for the majority of web browsing. The spatial constraints of mobile screens mean that AI Overviews can completely eliminate organic results from initial view, forcing users to scroll extensively to reach traditional search results.

This creates a cascading effect where mobile users, who typically have shorter attention spans and are less likely to scroll, become even less likely to encounter organic search results, further accelerating the traffic decline for publishers.

Editorial Analysis: The Death of Digital Discovery

The data reveals more than just declining click-through rates—it exposes a fundamental restructuring of how information is discovered and consumed online. For over two decades, the “above the fold” concept has been central to web design and digital marketing, based on the understanding that users focus primarily on content visible without scrolling.

The Spatial Economics of Attention: Google’s placement of AI Overviews above the fold while pushing organic results below it represents a deliberate choice about how attention—and ultimately economic value—is allocated in the digital ecosystem. By capturing user attention with comprehensive summaries, Google effectively becomes both the gateway and the destination for information consumption.

The Paradox of “Quality” Clicks: Google’s argument about “higher quality” clicks from AI Overviews misses the broader economic reality. Even if the remaining clicks are more engaged, a 79% reduction in traffic volume means publishers lose the scale necessary to sustain their operations through advertising revenue. Quality cannot compensate for the catastrophic loss of quantity.

The Innovation Disincentive: Perhaps most troubling is the long-term impact on content creation incentives. If publishers cannot monetize their content through search visibility, what motivation remains for producing the high-quality, original reporting that makes AI summaries valuable in the first place? This creates a dangerous feedback loop that could ultimately degrade the information ecosystem AI depends on.

Looking Ahead: The Future of Digital Publishing

Several critical developments will determine whether publishers can survive this spatial displacement:

Regulatory Intervention: Competition authorities in the UK and potentially the EU are beginning to investigate whether Google’s AI Overviews constitute anti-competitive behavior that unfairly disadvantages content creators.

Technology Responses: Publishers are exploring new technologies and platforms that can help them maintain direct relationships with audiences, reducing dependence on Google’s search traffic.

Business Model Evolution: The crisis is accelerating the shift toward subscription-based models, direct audience engagement, and alternative revenue streams that don’t depend on search visibility.

Google’s Policy Changes: Facing mounting pressure from publishers and regulators, Google may need to develop more equitable arrangements for content usage and revenue sharing.

The Broader Implications

The “below the fold” crisis represents more than a technical change to search results—it’s a fundamental shift in the power dynamics of the internet. By controlling both the distribution mechanism (search) and increasingly the consumption experience (AI summaries), Google has positioned itself as the primary intermediary between content creators and their audiences.

This consolidation of control raises profound questions about the future of the open web, the sustainability of independent journalism, and the diversity of voices in our information ecosystem. As publishers struggle to adapt to their new below-the-fold reality, the broader implications for democracy, commerce, and human knowledge remain to be seen.

The crisis also highlights the fragility of digital business models built on platform dependency. Publishers who spent decades optimizing for Google’s search algorithm now find themselves victims of that same platform’s evolution toward AI-powered results.

The Bottom Line: The evidence is unambiguous—AI Overviews are pushing organic search results below the fold at an unprecedented scale, creating an existential crisis for publishers dependent on search traffic. With traffic declines of 30-90% documented across various types of content sites, the digital publishing industry faces its most significant disruption since the rise of social media.

For publishers, the choice is stark: adapt rapidly to a world where search visibility no longer guarantees audience reach, or face the fate of The Planet D and countless other sites that have already shuttered due to AI-driven traffic collapse. The race is on to develop sustainable business models that don’t depend on Google’s good graces—because in the age of AI Overviews, those graces appear to be in increasingly short supply.

Sources and External Links:

- Press Gazette: Devastating Impact of Google AI Overviews Revealed

- NPR: Publishers Face ‘Extinction-Level Event’ from Google’s AI Search

- Digital Content Next: Google’s AI Overviews Linked to Lower Publisher Clicks

- Press Gazette: Publishers Lose 50% of Clickthrough Rate Due to AI Overviews

- Xponent21: Google’s AI Overviews Surpass 50% of Queries

- Search Engine Land: How Google AI Overviews Are Changing the PPC Game

- The Media Leader: Publishers Say Google’s AI Overviews Have Reduced Traffic Potential

- TechCrunch: Google’s AI Search Features Are Killing Traffic for Publishers

- WebProNews: Google AI Summaries Trigger 79% Traffic Drop for Publishers

This report synthesizes data from multiple independent studies and industry sources documenting the spatial displacement of organic search results and its devastating impact on digital publishing.

Related posts:

- Google’s AI Summaries: New Studies Reveal a Drastic Cut in Website Clicks

- What Is Google’s Search Generative Experience (SGE)? A Simple Beginner’s Guide

- The UGC Revolution: How Google AI’s Trust in Quora & Reddit Impacts SEO

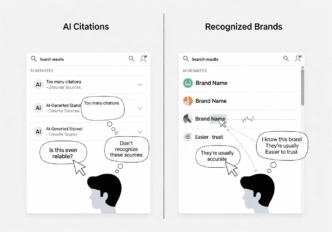

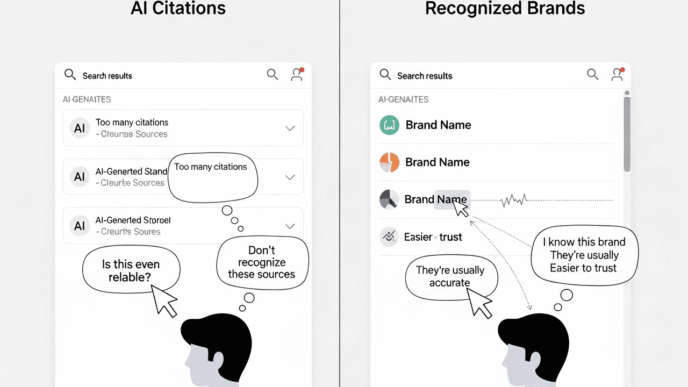

- Brand Trust in Search: Why Users Favor Recognized Names Over AI Suggestions