You’ve built an amazing SaaS product. Your features are killer, your UI is smooth, and your customers love it. But there’s one tiny problem: nobody can find you on Google.

Sound familiar? Here’s the uncomfortable truth: keyword research for SaaS isn’t like regular keyword research. You’re not selling widgets or coffee makers. You’re selling complex software solutions to businesses with long buying cycles, multiple decision-makers, and very specific problems.

I’ve watched countless SaaS founders waste months targeting the wrong keywords—chasing high-volume vanity metrics while their competitors quietly dominate the keywords that actually drive trial signups. Let me show you exactly how to avoid that trap and find the keywords that’ll fill your pipeline with qualified leads.

Table of Contents

ToggleWhy Is Keyword Research Different for SaaS Companies?

Before we dive into the how-to, let’s talk about why SaaS keyword strategy requires a completely different mindset.

Traditional e-commerce businesses target keywords like “buy red shoes” or “best laptop under $500.” These are transactional, high-intent, ready-to-purchase queries. But when was the last time someone searched “buy CRM software now” and immediately pulled out their credit card?

Never. That’s when.

B2B keyword research operates in a different universe. Your buyers spend weeks (sometimes months) researching solutions. They compare alternatives, read case studies, attend demos, and convince their team before making a decision.

This means your keyword strategy needs to capture prospects at every stage of this journey—not just at the moment they’re ready to buy.

What Makes SaaS Keywords Different from Regular Keywords?

Let me break down the key differences that’ll shape your entire keyword research process for B2B SaaS companies.

Longer Buying Cycles Mean Multiple Touchpoints

Your typical B2B software buyer needs 7-13 touchpoints before converting, according to industry research. Each touchpoint often starts with a different search query.

First search: “how to reduce customer churn” Second search: “customer success software features” Third search: “ChurnZero vs Gainsight” Fourth search: “customer success platform pricing”

See the pattern? You need to rank for keywords across this entire journey, not just the final comparison search.

Multiple Decision-Makers Change Search Behavior

According to Gartner, the average B2B buying committee has 6-10 stakeholders. Each person searches differently:

- The end user searches: “easiest project management tool”

- The manager searches: “project management software with reporting”

- The IT director searches: “project management tool security features”

- The CFO searches: “project management software ROI calculator”

Your SaaS SEO keywords need to speak to all these people.

Higher Price Points Demand Educational Content

A $50/month SaaS tool requires different content than a $50,000/year enterprise solution. The higher your price point, the more educational content you need ranking for problem-aware and solution-aware keywords.

Pro Tip: If your ACV (Annual Contract Value) exceeds \$10,000, allocate at least 60% of your keyword strategy to top-of-funnel educational content. These keywords build trust and authority long before prospects are ready to compare solutions.

What Are the Different Types of SaaS Keywords You Should Target?

Understanding keyword types is crucial for software keyword research. Let me walk you through the five categories that matter most.

1. Problem-Aware Keywords (Top of Funnel)

These keywords capture people who know they have a problem but don’t know solutions exist.

Examples:

- “why are customers leaving my business”

- “how to improve team collaboration remotely”

- “signs you need marketing automation”

- “ways to speed up customer support response”

Search volume: High Competition: Medium Conversion intent: Low (but essential for building authority)

Real example: Intercom ranks #1 for “customer engagement strategies”—capturing prospects months before they’re ready to buy chat software.

2. Solution-Aware Keywords (Middle of Funnel)

People searching these terms know what type of solution they need but haven’t chosen a specific tool.

Examples:

- “best email marketing software for ecommerce”

- “project management tools for remote teams”

- “CRM with automation features”

- “time tracking software for agencies”

Search volume: Medium to High Competition: High Conversion intent: Medium

These are goldmine keywords for SaaS because they target active researchers with budget allocated.

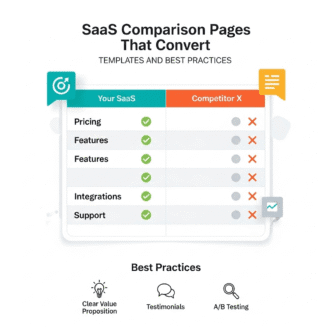

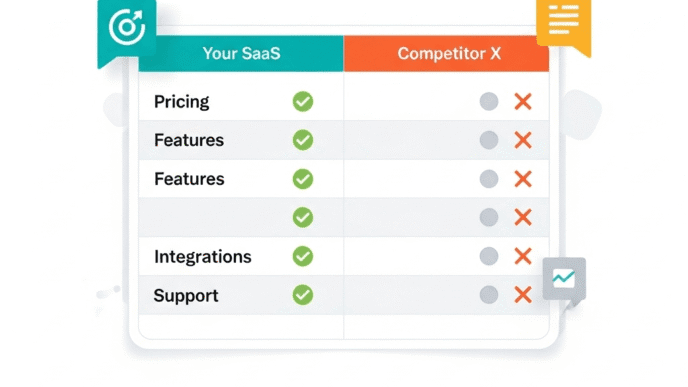

3. Product Comparison Keywords (Bottom of Funnel)

These high-intent keywords for SaaS target people actively evaluating specific solutions.

Examples:

- “HubSpot vs Salesforce”

- “Asana alternatives for startups”

- “Slack vs Microsoft Teams comparison”

- “best Mailchimp alternatives”

Search volume: Low to Medium Competition: High Conversion intent: Very High (5-10% conversion rates are common)

Pro Tip: Create comparison pages for every major competitor in your space, plus “alternatives” pages targeting their brand name. These pages convert incredibly well because visitors are literally shopping for alternatives.

4. Feature-Specific Keywords

These target prospects searching for specific functionality they need.

Examples:

- “CRM with email marketing automation”

- “project management software with time tracking”

- “accounting software for subscription billing”

- “analytics platform with custom dashboards”

Search volume: Low to Medium Competition: Medium Conversion intent: High

5. Jobs-to-be-Done Keywords

These capture searches around specific use cases or outcomes.

Examples:

- “software to onboard remote employees”

- “tools to reduce customer churn rate”

- “how to automate invoice reminders”

- “platform to manage freelance contractors”

Search volume: Low Competition: Low to Medium Conversion intent: Medium to High

Understanding SaaS SEO fundamentals helps you see how these keyword types fit into your overall strategy.

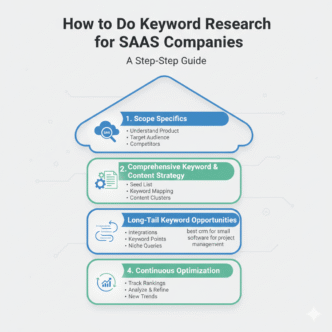

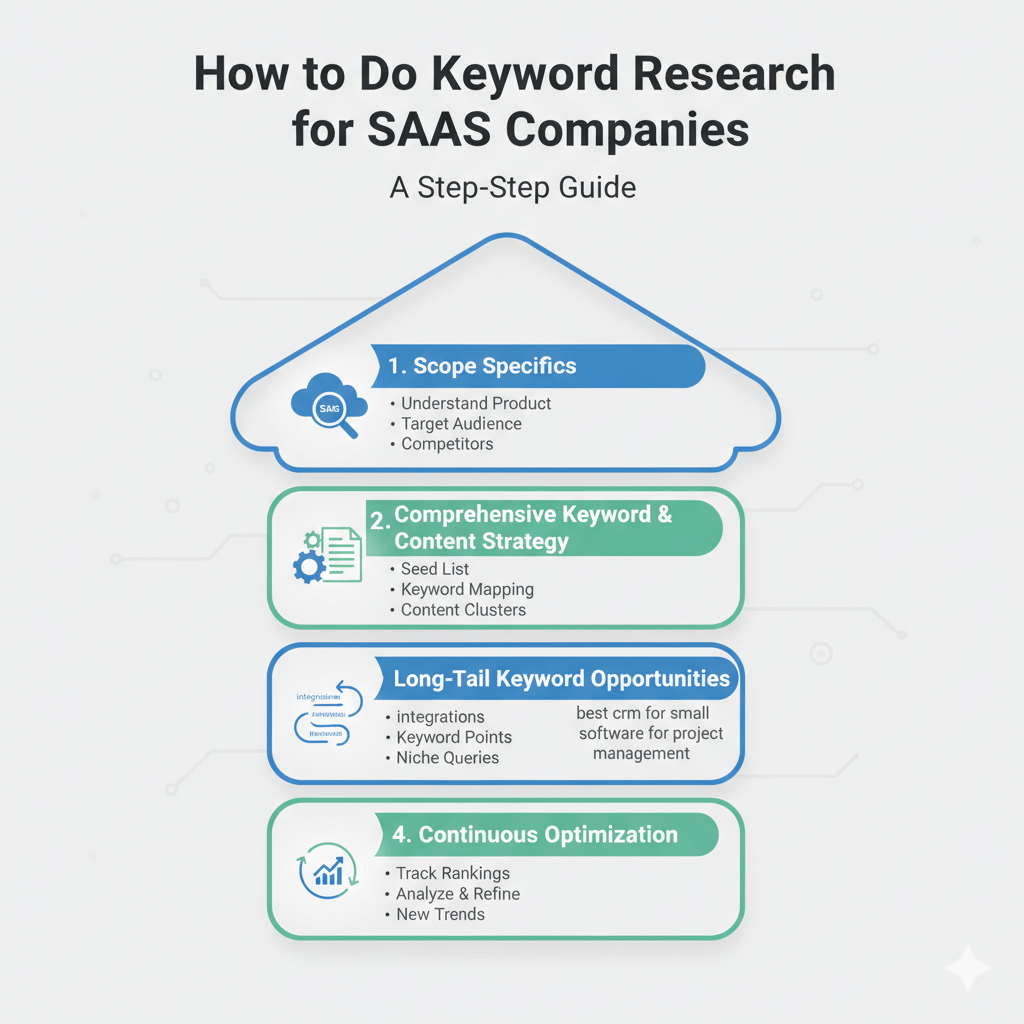

How Do You Actually Do Keyword Research for SaaS? (The Step-by-Step Process)

Alright, enough theory. Let’s get tactical with the exact keyword research process for B2B SaaS companies that actually works.

Step 1: Define Your Ideal Customer Profile First

This is where most people screw up. They jump straight into keyword tools without understanding who they’re targeting.

Spend 30 minutes documenting:

- Job titles: Who makes buying decisions? (Marketing Director, VP of Sales, CTO, etc.)

- Company size: Are you targeting startups, mid-market, or enterprise?

- Industry: Do you serve specific verticals? (SaaS, ecommerce, healthcare, etc.)

- Pain points: What specific problems keep them up at night?

- Current solutions: What tools do they currently use or consider?

Real example: When Notion started, they targeted “knowledge workers” and “remote teams” specifically—not just “anyone who needs productivity software.” This specificity shaped their entire keyword strategy.

Step 2: Mine Your Existing Customer Conversations

Your best keyword ideas are hiding in plain sight. Before touching any keyword research tools for SaaS, extract real language from:

Sales call recordings: What phrases do prospects use to describe their problems? They rarely say “I need customer success software”—they say things like “we’re losing customers and don’t know why.

Support tickets: What questions do customers ask most frequently? Each question is a potential keyword opportunity.

Customer reviews: Check your G2, Capterra, and TrustRadius profiles. How do satisfied customers describe your solution? Use their exact words.

Sales lost reasons: What features or capabilities did prospects mention when they chose competitors? These become feature-specific keyword targets.

Pro Tip: Create a spreadsheet with two columns: “What Customers Actually Say” and “Industry Jargon.” Most SaaS companies make content for the jargon column when they should target the customer language column.

Step 3: Use the Right Keyword Research Tools

Now we can finally open some tools. Here are the best keyword research tools for software companies:

| Tool | Best For | Pricing | Key Feature |

|---|---|---|---|

| Ahrefs | Comprehensive research | $99-999/mo | Best backlink data & keyword difficulty |

| SEMrush | Competitor analysis | $119-449/mo | Excellent competitor keyword gap tool |

| Clearscope | Content optimization | $170-1200/mo | AI-powered content briefs |

| AnswerThePublic | Question-based keywords | Free-$99/mo | Visualizes question patterns |

| Google Keyword Planner | Search volume validation | Free | Direct from Google (conservative estimates) |

| AlsoAsked | People Also Ask data | Free-$15/mo | Maps related questions |

You don’t need all of these. Start with one comprehensive tool (Ahrefs or SEMrush) and supplement with free tools.

Step 4: Start with Seed Keywords

Enter 5-10 broad terms related to your product category into your keyword tool:

- Your product category (e.g., “CRM software”)

- Your main features (e.g., “email automation”)

- Problems you solve (e.g., “sales pipeline management”)

- Alternative terms (e.g., “customer database”)

- Competitor names (for comparison research)

For each seed keyword, your tool will generate hundreds or thousands of related terms. Don’t get overwhelmed—we’ll filter next.

Step 5: Apply Strategic Filters to Find Hidden Gems

This is where competitive keyword analysis gets interesting. Most SaaS companies only look at search volume, ignoring the metrics that actually matter.

Filter by keyword difficulty (KD): If you’re a newer site (Domain Rating below 40), target keywords with KD under 30. Established sites can aim for KD 30-50.

Filter by search intent: Look at the actual search results. If you target “project management” and see only articles about project management careers, that’s the wrong intent for your software.

Filter by SERP features: Keywords with featured snippets, “People Also Ask” boxes, or “Alternatives” sections are often easier to rank for than traditional 10 blue links.

Prioritize by business value: A keyword with 50 monthly searches that targets your exact ICP is more valuable than 5,000 monthly searches from tire-kickers.

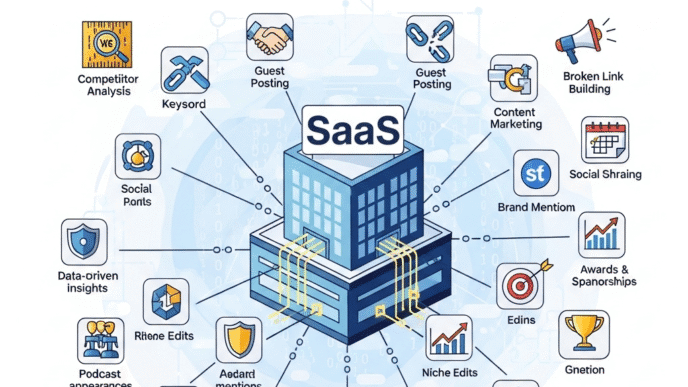

Step 6: Analyze Competitor Keywords (The Smart Way)

Here’s how to identify bottom-funnel SaaS keywords your competitors are winning:

Enter 3-5 competitors into Ahrefs or SEMrush: Look specifically at their “Organic Keywords” report.

Filter for their top-performing pages: Sort by traffic or rankings to see which pages drive the most value.

Identify keyword gaps: Use the “Keyword Gap” tool to find keywords your competitors rank for but you don’t. These are low-hanging fruit.

Study their comparison pages: What comparison and alternative keywords do they target? You should target the same ones (including comparisons against them).

Analyze their content clusters: Do they have comprehensive guides that rank for dozens of related terms? That’s your template for what works in your niche.

Real example: When I analyzed ClickUp’s SEO strategy, I found they had comparison pages targeting every major competitor—over 50 separate pages. Each page ranks for 10-50 related keywords and drives consistent trial signups.

Understanding SaaS content strategy helps you see how competitors build topical authority.

Step 7: Validate Search Intent with Manual SERP Analysis

Never trust keyword metrics alone. For every keyword you plan to target, manually Google it and analyze the top 10 results:

What content types rank? (Blog posts, comparison pages, product pages, videos, etc.) What’s the content depth? (500 words or 5,000 words?) Who’s ranking? (Competitors, industry publications, or random blogs?) What angle do they take? (Beginner guides, advanced tactics, tool comparisons?)

If the top 10 results are all comprehensive guides but you planned to write a 500-word blog post, you’ll never rank. Match or exceed the content depth and quality of existing top results.

Pro Tip: If you see lots of outdated content (published 2+ years ago) in the top 10, that’s a golden opportunity. Create a fresh, comprehensive piece and you can often leap into the top 5 within months.

How Do You Find High-Intent Keywords That Actually Convert?

This is the million-dollar question—literally, for many SaaS companies.

High-intent keywords are searches where the person is actively looking for a solution and ready to evaluate options. These keywords have lower search volume but dramatically higher conversion rates.

Identifying Bottom-Funnel Intent Signals

Look for keywords containing these modifiers:

Comparison indicators:

- “vs” or “versus”

- “compared to”

- “alternative to”

- “competitor”

- “better than”

Evaluation indicators:

- “best [solution] for [use case]”

- “top [number] [tools]”

- “reviews”

- “pricing”

- “features”

Action indicators:

- “demo”

- “trial”

- “free”

- “sign up”

- “how to use”

Example: “Salesforce alternatives for small business” has only 200 monthly searches but converts at 8-12% because everyone searching it is actively shopping for a CRM.

The Feature + Use Case Formula

One of my favorite techniques for finding high-intent keywords for SaaS is combining features with use cases:

[Core Feature] + [For] + [Specific Use Case/Industry]

Examples:

- “time tracking software for law firms”

- “CRM with WhatsApp integration for real estate”

- “project management tool for construction companies”

- “email marketing platform for Shopify stores”

These ultra-specific keywords have tiny search volume but incredibly high intent. The people searching them have very specific needs and budget allocated.

Mining “People Also Ask” for Intent

Google’s “People Also Ask” boxes reveal actual questions people have at different stages:

Early stage: “What is [solution]?” Middle stage: “How does [solution] work?” Late stage: “How much does [solution] cost?”

Target these questions with dedicated FAQ sections or full articles. They often trigger featured snippets, giving you position zero even if your domain authority is low.

What Are the Biggest Keyword Research Mistakes SaaS Companies Make?

Let me save you from the painful mistakes I see constantly in SaaS keyword strategy.

Mistake #1: Chasing Volume Over Intent

The trap: Targeting “CRM software” (33,000 monthly searches) instead of “CRM for insurance agents” (200 monthly searches).

Why it fails: The high-volume keyword is dominated by enterprise software review sites with Domain Ratings over 80. You’ll never rank. Meanwhile, the specific keyword has low competition and prospects with actual buying intent.

The fix: Prioritize keyword difficulty and business value over search volume. A keyword with 100 monthly searches that converts at 10% beats a keyword with 10,000 searches that converts at 0.01%.

Mistake #2: Ignoring Keyword Difficulty Completely

The trap: Building an entire content calendar around keywords with difficulty scores of 70+ when your site’s Domain Rating is 15.

Why it fails: You’re competing against sites with 10 years of SEO work and thousands of backlinks. Your content will sit on page 8 forever.

The fix: Use this simple framework for keyword difficulty for SaaS:

| Your Domain Rating | Target Keyword Difficulty | Timeline to Rank |

|---|---|---|

| 0-20 (New site) | 0-20 KD | 6-12 months |

| 20-40 (Growing) | 20-40 KD | 3-9 months |

| 40-60 (Established) | 30-60 KD | 2-6 months |

| 60+ (Authority) | Any difficulty | 1-4 months |

Mistake #3: Not Mapping Keywords to Buyer Journey Stages

The trap: Creating only top-of-funnel educational content or only bottom-funnel comparison pages, with nothing in between.

Why it fails: You need content at EVERY stage of the buyer journey. Educational content builds trust and authority but doesn’t directly drive conversions. Comparison content converts but won’t rank well without domain authority built through broader content.

The fix: Follow the 40-30-30 rule:

- 40% top-of-funnel (problem-aware keywords)

- 30% middle-of-funnel (solution-aware keywords)

- 30% bottom-of-funnel (product comparison keywords)

This balanced approach builds authority while capturing high-intent traffic.

Mistake #4: Forgetting to Track Keyword Cannibalization

The trap: Creating multiple pieces of content targeting the same keyword without clear differentiation.

Why it fails: Your pages compete against each other, confusing Google about which one to rank. Often, neither ranks well.

The fix: Maintain a content inventory spreadsheet tracking:

- URL

- Primary keyword

- Secondary keywords (2-3 per piece)

- Content type (blog, comparison, guide, etc.)

- Publishing date

- Current ranking

If you find overlap, either consolidate content or clearly differentiate the target keyword for each piece.

Mistake #5: Skipping Long-Tail Keyword Variations

The trap: Only targeting broad head terms like “email marketing software” and ignoring specific variations.

Why it fails: You miss hundreds of low-competition, high-intent searches that collectively drive significant traffic.

The fix: For every main keyword, identify 5-10 long-tail variations:

Main keyword: “CRM software” Long-tail variations:

- “CRM software for real estate agents”

- “CRM software with email marketing”

- “simple CRM for small business”

- “affordable CRM for startups”

- “CRM software that integrates with Gmail”

Each variation targets a specific need or concern, often with much lower competition.

Learning from common SaaS SEO mistakes helps you avoid these pitfalls entirely.

How Do You Organize and Prioritize Your SaaS Keywords?

You’ve researched hundreds (maybe thousands) of keywords. Now what? Let’s talk about organizing your SaaS SEO keywords into an actionable plan.

Create a Keyword Prioritization Framework

Score each keyword on these four factors (1-10 scale):

Business relevance: How closely does this keyword align with your ICP and use cases?

Ranking probability: Based on your current domain authority and the keyword difficulty, can you realistically rank in the next 6-12 months?

Traffic potential: What’s the actual search volume, not just what the tool shows? (Google tends to bucket similar keywords together.)

Conversion likelihood: Based on search intent, how likely is this traffic to convert to trials or demos?

Multiply these scores together for a total priority score. Tackle highest-scoring keywords first.

Build Content Clusters Around Topics

Don’t think in individual keywords—think in topic clusters:

Pillar content: One comprehensive guide targeting your main keyword (e.g., “Email Marketing Guide”)

Cluster content: 8-12 supporting pieces targeting related keywords:

- “Best email marketing tools”

- “Email marketing metrics to track”

- “How to improve email open rates”

- “Email marketing automation workflows”

- Email marketing vs social media marketing

All cluster content links to the pillar and each other, creating a strong topical authority signal for search engines.

Real example: Ahrefs has a pillar guide on “SEO” with over 50 cluster posts covering specific tactics, tools, and strategies. This cluster ranks for thousands of keywords and positions them as the authority.

Map Keywords to Content Types

Different keywords demand different content formats:

| Keyword Type | Best Content Format | Example |

|---|---|---|

| Problem-aware | How-to blog post or guide | “How to reduce shopping cart abandonment” |

| Solution-aware | Ultimate guide or listicle | “10 best ecommerce platforms for startups” |

| Comparison | Dedicated comparison page | “Shopify vs WooCommerce: Which is better? |

| Feature-specific | Product landing page | “Email marketing software with A/B testing” |

| Use case | Case study or vertical page | “CRM for financial advisors” |

Match the format to search intent, or you won’t rank no matter how good your content is.

What Tools and Resources Make SaaS Keyword Research Easier?

Let me share the exact toolkit I use for keyword research tools for SaaS companies.

Essential Paid Tools (Pick One)

Ahrefs ($99-999/month):

- Best overall keyword database

- Excellent competitor analysis

- Superior backlink data

- Clean, intuitive interface

Best for: Companies serious about SEO who need comprehensive data

SEMrush ($119-449/month):

- Strong competitor keyword gap analysis

- Great for PPC + SEO integration

- Position tracking across locations

- Content marketing toolkit included

Best for: Companies running both SEO and paid search campaigns

Free Tools That Actually Work

Google Keyword Planner:

- Free with Google Ads account

- Search volume directly from Google

- Good for validating monthly search estimates

Limitation: Search volume ranges are broad unless you’re actively spending on ads

AnswerThePublic:

- Visualizes questions people ask

- Great for finding FAQ and blog topics

- Shows prepositions and comparisons

Limitation: Limited searches on free plan (3 per day)

Google Search Console:

- Shows keywords you already rank for

- Identifies pages with ranking opportunity

- 100% free and directly from Google

Limitation: Only shows data for your own site

AlsoAsked:

- Maps “People Also Ask” questions

- Shows relationship between questions

- Helps identify content gaps

Limitation: Limited free searches

AI-Powered Keyword Research (The Future)

ChatGPT/Claude for keyword ideation: Prompt: “I have a [type of SaaS]. My target customers are [ICP description]. Generate 30 keyword ideas across problem-aware, solution-aware, and comparison categories that this audience would search for.”

Pro Tip: AI tools are excellent for generating keyword ideas and variations but terrible at providing search volume or difficulty data. Use AI for ideation, then validate with traditional tools.

Clearscope or Surfer SEO: These tools analyze top-ranking pages and tell you exactly which related keywords and topics to include in your content. They’re essentially AI-powered content briefs.

Worth it if you’re producing 4+ pieces monthly and want to ensure each piece covers all relevant subtopics.

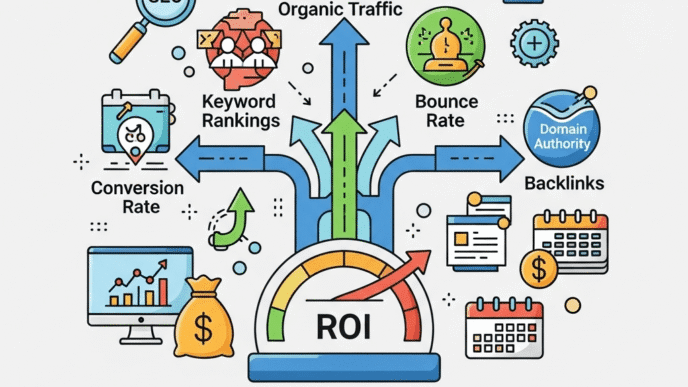

How Do AI Search Changes Affect SaaS Keyword Research?

With Google’s Search Generative Experience (SGE) and AI Overviews rolling out, keyword research for SaaS is evolving fast.

What’s Changing with AI Search?

Zero-click searches are increasing: Google’s AI summaries answer questions directly in search results, reducing clicks to websites.

Featured snippets matter more: AI often pulls information from featured snippets to generate responses.

Conversational queries are growing: People search more naturally with AI, using full questions instead of keyword fragments.

Brand mentions in AI results: AI tends to reference established brands more frequently than smaller players.

How to Adapt Your Keyword Strategy

Target conversational, question-based keywords: Optimize for “how do I [accomplish task] with [type of software]” instead of just “[software type] features.”

Create content AI can’t replicate: Focus on original data, first-hand experience, case studies, and customer stories that AI can’t summarize from public sources.

Build brand authority: Get mentioned in industry publications, research reports, and comparison sites. These sources feed AI training data.

Optimize for featured snippets: Use clear definitions, bullet points, and structured data. AI pulls heavily from featured snippet content.

Go deeper than AI summaries: If AI can answer a query in 2-3 sentences, go 10x deeper with comprehensive analysis, examples, and tactical implementation steps.

According to research from <a href=”https://www.brightedge.com/resources/research-reports/generative-ai-future-search” rel=”nofollow”>BrightEdge</a>, 82% of SaaS buyers still prefer to research on company websites even when AI summaries are available—they want depth and specificity.

Understanding how AI impacts SaaS SEO strategy helps you stay ahead of algorithm changes.

Real-World Keyword Research Example: Breaking Down a SaaS Success Story

Let me walk you through how Notion (now valued at $10B+) used strategic keyword research to dominate their category.

Notion’s Keyword Strategy (What They Did Right)

Phase 1: Niche Down Initially Instead of competing for “productivity software” (dominated by Microsoft and Google), they targeted:

- “collaborative workspace tools”

- “all-in-one workspace”

- “Notion templates”

- “digital notebook alternative”

These had lower volume but manageable competition and highly relevant traffic.

Phase 2: Build Comparison Content They created pages for:

- “Notion vs Evernote”

- “Notion vs Confluence”

- “Notion vs Trello”

- “Best Evernote alternatives” (where they rank #1)

Each page captures high-intent traffic from people actively shopping for alternatives.

Phase 3: Enable User-Generated Content Notion’s template gallery and community create thousands of pages that naturally rank for long-tail keywords:

- “Notion template for [specific use case]”

- “How to build [specific workflow] in Notion”

- “Notion setup for [specific role/industry]”

This user-generated content creates a self-reinforcing SEO flywheel.

Phase 4: Expand to Broader Terms Only after building authority in their niche did they target broader terms like:

- “productivity tools”

- “project management software”

- “knowledge management system”

The Result: Notion now ranks for over 400,000 keywords and receives millions of monthly organic visits—a massive portion of their growth engine.

Common Questions About Keyword Research for SaaS

How many keywords should I target?

Start with 20-30 priority keywords across different funnel stages. As you create content and build authority, expand to 100+ keywords. Established SaaS companies often target 500-1,000+ keywords.

Quality beats quantity. Better to rank #1 for 30 highly relevant keywords than #40 for 300 irrelevant ones.

Should I target competitor brand names?

Absolutely, but do it ethically. Create honest comparison pages like “[Your Tool] vs [Competitor]” or “Best [Competitor] Alternatives.” Don’t use their brand name misleadingly in your meta tags or content.

According to analysis from <a href=”https://www.semrush.com/blog/competitor-keywords/” rel=”nofollow”>SEMrush</a>, comparison and alternative keywords convert 3-5x better than general category terms.

How often should I update my keyword research?

Quarterly at minimum. Search trends shift, competitors launch new features, and your own product evolves. Review your keyword strategy every 3 months:

- Are you ranking for target keywords?

- Have new competitors entered the space?

- Are there new features to target?

- Have customer pain points shifted?

What if my SaaS category has low search volume?

This is common for innovative or niche products. Focus on:

- Problem-based keywords rather than solution-based (people may not know your category exists yet)

- Creating the category through consistent content and positioning

- Adjacent categories where your product can compete

- Alternative solutions your ICP currently uses

Example: Before “sales engagement platform” had search volume, Outreach.io targeted “sales automation software” and “email outreach tools.”

Should I target my own brand name?

Yes! Create dedicated pages for:

- [Your Brand] + “pricing”

- [Your Brand] + “reviews”

- [Your Brand] + “vs [competitor]”

- [Your Brand] + “alternative”

This protects your brand SERP from competitors who may try to capture your brand traffic with alternative/review content.

How do I find what keywords my competitors rank for?

Enter their domain into Ahrefs or SEMrush:

- Navigate to “Organic Keywords” or “Organic Research”

- Filter by traffic or position to see their top pages

- Export the full keyword list

- Analyze which keywords drive them the most traffic

- Identify gaps where they rank but you don’t

This competitive keyword analysis reveals proven opportunities in your space.

What’s a good keyword difficulty score to target?

It depends on your Domain Rating (DR):

- DR 0-20: Target KD 0-20

- DR 20-40: Target KD 20-35

- DR 40-60: Target KD 30-50

- DR 60+: Target any KD, prioritize by business value

New sites should focus 80% of effort on low-difficulty keywords and 20% on aspirational targets to build authority over time.

How long does it take to rank for SaaS keywords?

Realistic timelines:

- Low-competition long-tail: 1-3 months

- Medium-competition keywords: 4-9 months

- High-competition category terms: 12-24 months

These assume consistent content creation, technical SEO health, and gradual link building. SaaS SEO is a long game—commit for 18+ months to see transformative results.

For more insights on timing and expectations, check out the SaaS SEO timeline section.

Final Thoughts: Your Keyword Research Action Plan

Let’s wrap this up with a clear action plan you can implement immediately.

Week 1: Foundation

- Document your ICP and buyer personas

- Mine customer conversations for keyword ideas

- Set up your primary keyword research tool (Ahrefs or SEMrush)

- Create your keyword tracking spreadsheet

Week 2: Discovery

- Generate 200+ seed keywords using tools and customer language

- Analyze top 5 competitors’ keyword strategies

- Identify 50 priority keywords across all funnel stages

- Manually verify search intent for top 20 keywords

Week 3: Organization

- Score keywords using the prioritization framework

- Map keywords to content types and buyer journey stages

- Create your first 3 topic clusters

- Build your 90-day content calendar

Week 4: Execution

- Start creating content for highest-priority keywords

- Set up rank tracking for your targets

- Implement internal linking between related content

- Schedule monthly keyword review sessions

Remember: Keyword research for SaaS isn’t a one-time project—it’s an ongoing process that evolves with your product, market, and customers.

The SaaS companies dominating organic search today started this process 2-3 years ago. They committed to consistent keyword research, strategic content creation, and playing the long game.

Your competitors are either already doing this or they’re not. If they’re not, this is your unfair advantage. If they are, you can’t afford to wait any longer.

The best time to start your SaaS keyword strategy was two years ago. The second-best time is today.

Now stop reading and start researching. Your pipeline depends on it.