You’re staring at a spreadsheet with 47,000 keywords, and your boss just asked which ones you’re prioritizing this quarter. Your stomach drops. Half these keywords are outdated, a third are duplicates across different teams, and you honestly can’t remember why you’re tracking “enterprise cloud solutions comparison tool best practices” (92 monthly searches, seriously?).

Welcome to the beautiful chaos of enterprise keyword research.

Here’s the thing: Managing keyword research for a Fortune 500 company isn’t just “regular keyword research but bigger.” It’s an entirely different beast. You’re juggling multiple brands, international markets, product lines that compete with each other, and stakeholders who all think their keywords are the most important.

According to BrightEdge, the average enterprise manages between 15,000-50,000 target keywords across their properties. Yet 73% of enterprise SEO teams admit they have no systematic approach to prioritizing which keywords actually drive business outcomes.

That’s not keyword research—that’s keyword hoarding with a fancy spreadsheet.

In this guide, I’ll walk you through exactly how to build an enterprise keyword research strategy that scales across markets, manages complexity without losing your mind, and actually connects keywords to revenue instead of vanity metrics.

Let’s turn that overwhelming keyword list into a strategic asset.

Table of Contents

ToggleWhat Makes Enterprise Keyword Research Different from Traditional Approaches?

Enterprise keyword research operates in a completely different reality than small business keyword targeting. The scale, complexity, and organizational challenges require fundamentally different strategies.

Traditional keyword research might involve finding 50-200 target keywords for a single market. Enterprise operations require managing 10,000-100,000+ keywords across multiple markets, languages, product lines, and business units.

Scale and Complexity Challenges

You’re not just researching keywords—you’re building classification systems, managing taxonomies, coordinating across teams, and ensuring brand consistency while allowing local market flexibility. One enterprise client I worked with had 14 different departments independently researching keywords with 67% overlap and zero coordination.

That’s not efficiency. That’s seven-figure waste on duplicate effort.

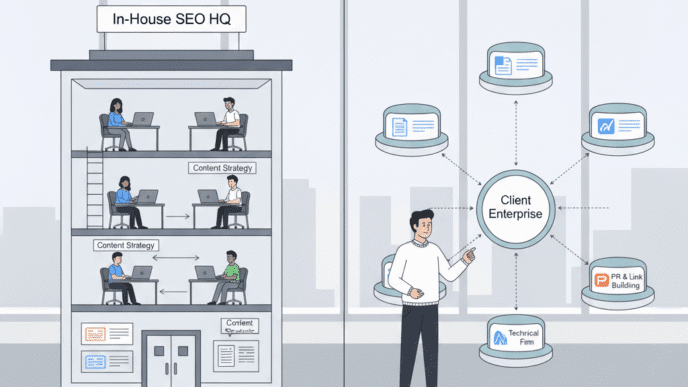

Multi-Stakeholder Coordination

Enterprise keyword portfolio management means navigating politics as much as data. Your B2B product team targets “enterprise software,” your B2C division wants “business software,” and your brand team insists everything should include your company name (spoiler: it shouldn’t).

According to research from Conductor, 68% of enterprise SEO professionals cite stakeholder alignment as a bigger challenge than the actual keyword research itself.

Resource and Tool Requirements

Free keyword tools won’t cut it at enterprise scale. You need platforms that handle millions of data points, provide API access for automation, and integrate with your tech stack. We’re talking annual tool budgets of $50K-$200K just for keyword intelligence platforms.

Pro Tip: The biggest mistake enterprise teams make is treating keyword research as a one-time project. At scale, it’s an ongoing program requiring dedicated resources, systematic processes, and continuous optimization based on performance data.

Why Does Enterprise Keyword Research Strategy Matter for Large Organizations?

Because flying blind with thousands of keywords costs you millions in misdirected resources and missed opportunities.

Multi-market keyword research done wrong means your French team accidentally targets keywords that cannibalize your German market. Your product launch team optimizes for keywords with zero commercial intent while ignoring high-converting terms your competitors dominate.

Business Impact of Strategic Keyword Management

A 2024 study by Search Engine Journal found that enterprises with documented keyword strategies achieve 3.2x higher organic revenue per keyword compared to organizations managing keywords reactively.

Here’s what proper enterprise keyword research enables:

- Resource optimization – Focus content creation on keywords that drive actual business outcomes

- Competitive advantage – Systematically identify gaps where competitors are weak

- Revenue forecasting – Predict organic revenue impact of keyword targeting decisions

- Market expansion – Enter new markets with data-driven keyword intelligence

- Brand protection – Ensure you own visibility for brand-critical terms across all markets

Without strategic keyword management, you’re basically throwing content at the wall and hoping something ranks. That might work for small sites. At enterprise scale, it’s career-limiting.

How Do You Build an Enterprise Keyword Research Framework?

Let’s break down the systematic approach to enterprise keyword research strategy for multiple markets that actually scales.

Step 1: Define Clear Business Objectives and Segmentation

Before researching a single keyword, you need crystal clear objectives tied to business outcomes. “Increase organic traffic” isn’t an objective—it’s a vanity metric.

Real enterprise objectives:

- Increase qualified B2B demo requests by 40% (specific keywords drive demos)

- Capture 25% share of voice in enterprise SaaS category (competitive displacement)

- Launch in 5 European markets with localized keyword strategy (expansion)

- Reduce customer acquisition cost below $500 (efficiency through organic)

Next, segment your keyword research by these strategic dimensions:

Market segmentation:

- Geographic markets (US, UK, Germany, etc.)

- Customer segments (enterprise, mid-market, SMB)

- Product lines (if managing multiple offerings)

- Funnel stages (awareness, consideration, decision)

- Business units (if multiple brands/divisions)

This segmentation becomes your keyword mapping strategy foundation. Every keyword gets tagged with these attributes, enabling sophisticated prioritization later.

Step 2: Conduct Comprehensive Seed Keyword Discovery

Your seed keywords are the foundation everything else builds from. At enterprise scale, seed keyword generation requires systematic methodology, not brainstorming sessions.

Enterprise seed keyword sources:

- Internal stakeholder workshops – Product teams, sales, customer success know the language customers actually use

- Customer research data – Sales call transcripts, support tickets, survey responses reveal real queries

- Competitor analysis – What keywords drive traffic to top 10 competitors?

- Industry taxonomy mapping – Standard industry terms and classification systems

- Historical performance data – Your existing best-performing keywords

- Product/service taxonomy – Every product, feature, use case, and benefit

Pro Tip: Create a seed keyword repository organized by business segment and funnel stage. Tag each seed with business value indicators (revenue potential, strategic importance) to guide expansion research. This becomes your single source of truth preventing duplicate research across teams.

Step 3: Scale Keyword Expansion with Enterprise Tools

With solid seeds, now you expand to thousands of variations. This is where enterprise keyword tools separate from basic platforms.

Essential enterprise keyword research tools:

| Tool | Best For | Enterprise Features | Pricing |

|---|---|---|---|

| Semrush | Comprehensive research | API access, 40+ databases, competitor keywords | $450-$1,200/mo |

| Ahrefs | Competitor analysis | 10B keyword database, SERP history | $399-$999/mo |

| Conductor | Enterprise workflow | Keyword forecasting, revenue mapping | $50K+/year |

| BrightEdge | Enterprise platform | AI recommendations, data studio integration | $100K+/year |

| Google Keyword Planner | Search volume data | Free, direct Google data, location targeting | Free |

| AnswerThePublic | Question keywords | Visual keyword research, question formats | $99/mo |

Keyword expansion methodology:

- Start with high-value seeds – Input priority seeds into multiple tools

- Extract related keywords – Pull related terms, questions, and variations

- Analyze competitor keywords – Identify gaps where competitors rank but you don’t

- Mine SERP features – Extract “People Also Ask” and related searches

- International keyword translation – Don’t just translate—research local search behavior

- Long-tail variation discovery – Expand into specific, lower-competition phrases

This expansion phase should generate 10,000-100,000+ keyword candidates depending on your business scope.

Step 4: Implement Keyword Clustering Enterprise Methodology

Raw keyword lists are useless. Keyword clustering enterprise strategies group semantically related keywords to guide content strategy and prevent keyword cannibalization.

Modern clustering uses machine learning to group keywords by search intent and SERP overlap. If two keywords show 60%+ of the same URLs ranking, they belong in the same cluster—meaning one piece of content should target both.

Clustering approaches for enterprises:

Manual clustering (small-scale):

- Group keywords by topic and intent

- Works for <5,000 keywords

- Labor-intensive but offers maximum control

Semi-automated clustering:

- Tools like Keyword Insights or SearchResponse

- Review and refine automated suggestions

- Balances scale with quality

Fully automated clustering:

- Enterprise platforms like Conductor or BrightEdge

- ML-powered grouping by SERP similarity

- Required for 50,000+ keyword portfolios

According to research from Ahrefs, proper keyword clustering reduces content needs by 40-60% while improving rankings because you’re creating comprehensive content targeting multiple related keywords instead of thin pages for each variation.

Step 5: Prioritize Keywords by Business Value

This is where most enterprise keyword research falls apart. Teams treat all keywords equally or prioritize purely by search volume. Fatal mistake.

Enterprise keyword prioritization framework:

Business Value Score = (Search Volume × Click Potential × Conversion Value × Ranking Difficulty⁻¹)

Let’s break down each component:

Search Volume – Monthly searches (but don’t overweight this)

Click Potential – What % of searches result in organic clicks? (SERP features steal clicks)

Conversion Value – What’s this keyword worth in revenue? (tie keywords to actual business outcomes)

Ranking Difficulty – How hard to rank? (balance opportunity with effort required)

Real-world example: A SaaS client discovered their highest-volume keyword (45,000 searches/month) had 8% click-through rate due to SERP features, while a 3,200 search/month keyword had 35% CTR and 4x higher demo conversion rate. Guess which keyword got priority?

For comprehensive approaches to Enterprise SEO strategy, prioritization frameworks must align keyword targeting with overall business objectives rather than optimizing for vanity metrics.

Step 6: Create Enterprise Keyword Mapping Strategy

Keyword mapping strategy assigns specific keywords to specific URLs, preventing cannibalization and ensuring comprehensive coverage.

Your mapping framework should answer:

- Which page targets which keywords?

- What’s the primary keyword vs. secondary keywords for each page?

- Which keywords require new content vs. optimizing existing pages?

- How do keywords map to buyer journey stages?

Enterprise mapping best practices:

- One primary keyword cluster per page – Don’t spread focus too thin

- Multiple secondary keywords allowed – Related terms that naturally fit

- Document in centralized system – Keyword mapping spreadsheet or enterprise platform

- Update based on performance – Remap underperforming assignments

- Coordinate across teams – Prevent different teams from targeting same keywords

Pro Tip: Use a keyword mapping matrix with columns for: Target URL, Primary Keyword, Secondary Keywords (3-5), Search Volume, Current Ranking, Priority Level, and Content Status. This becomes your content roadmap and prevents duplicate targeting across your organization.

What Are the Best Enterprise Keyword Tools for Large-Scale Research?

You can’t manage enterprise keyword research with free tools. You need platforms built for scale, automation, and integration with your tech stack.

Comprehensive Enterprise Keyword Research Platforms

Conductor Searchlight

Best for enterprises needing the full suite—keyword research, content recommendations, performance tracking, and revenue attribution. The platform uses machine learning to identify keyword opportunities based on your specific domain authority and competitive landscape.

Pricing starts around $50K annually but scales based on keyword tracking volume and features. Worth it for enterprises managing 20,000+ keywords across multiple markets.

BrightEdge

The most comprehensive enterprise SEO platform with deep keyword intelligence, predictive analytics, and executive-level reporting. Particularly strong for multi-location businesses needing local keyword research at scale.

According to Search Engine Land, BrightEdge users report 40% reduction in keyword research time through automation while improving keyword-to-revenue attribution.

Expect $100K+ annual investment for enterprise deployments.

Semrush Enterprise

More affordable than Conductor or BrightEdge while still offering enterprise-grade features. Excellent international database coverage (40+ countries), competitor keyword analysis, and API access for custom integrations.

The Position Tracking tool handles 100,000+ keyword monitoring, and the Keyword Magic Tool database includes 20+ billion keywords. Enterprise plans run $450-$1,200 monthly depending on limits.

Specialized Tools for Specific Enterprise Needs

For competitor intelligence: Ahrefs excels at identifying competitor keyword gaps and understanding what drives their organic traffic. The Content Gap tool specifically shows keywords competitors rank for that you don’t—gold for enterprise competitive strategy.

For international research: Semrush and Ahrefs both offer robust international databases, but verify coverage in your specific target markets. Some platforms have weak data for emerging markets.

For question-based keywords: AnswerThePublic and AlsoAsked specifically mine question formats. Critical for content marketing and voice search optimization.

For local enterprise: BrightEdge Local and SOCi specialize in multi-location keyword research. Essential for retail, healthcare, or other businesses with hundreds of physical locations.

For keyword forecasting: Conductor’s Forecast feature predicts traffic and conversion impact of keyword targeting decisions. Game-changing for justifying enterprise SEO budgets by projecting ROI before implementation.

Tool Selection Framework for Enterprises

| Consideration | Recommended Approach |

|---|---|

| Budget <$50K/year | Semrush or Ahrefs + Google tools |

| Budget $50-150K/year | Conductor or BrightEdge |

| Budget >$150K/year | BrightEdge + specialized tools |

| Multi-location (500+ sites) | BrightEdge Local or SOCi |

| International (10+ markets) | Semrush or Conductor |

| Heavy competitor focus | Ahrefs + Semrush combination |

How Do You Manage Enterprise Keyword Portfolio at Scale?

Having thousands of keywords is one thing. Actually managing them without chaos requires systematic enterprise keyword portfolio management processes.

Building Keyword Governance Framework

Keyword ownership and accountability:

- Assign keyword segment owners (product line, market, business unit)

- Define approval processes for new keyword targeting

- Create escalation paths for keyword conflicts between teams

- Document decision-making criteria for prioritization

One Fortune 500 client implemented keyword governance preventing duplicate efforts. Result? 40% reduction in content creation costs while improving organic performance because teams stopped competing against themselves.

Automation and Monitoring Systems

Enterprise keyword portfolio management requires automated systems tracking performance across thousands of keywords. Manual tracking is impossible at scale.

Essential automation:

- Rank tracking automation – Daily monitoring for priority keywords, weekly for others

- SERP feature monitoring – Track featured snippets, People Also Ask, local packs

- Competitor tracking – Automated alerts when competitors gain/lose rankings

- Performance dashboards – Real-time visibility into keyword performance by segment

- Opportunity identification – ML algorithms spotting quick-win opportunities

Tools like BrightEdge, Conductor, and SEOmonitor offer enterprise-grade automation reducing manual effort by 70-80%.

Keyword Performance Review Cycles

Monthly reviews:

- Top 100 priority keywords performance

- SERP feature wins/losses

- Competitor movement on strategic keywords

- Quick-win opportunities requiring minimal effort

Quarterly strategic reviews:

- Overall portfolio performance vs. objectives

- Keyword prioritization adjustments based on business changes

- New market or product keyword research initiatives

- Budget reallocation based on keyword ROI

Annual comprehensive audits:

- Complete portfolio review and pruning

- Competitive landscape reassessment

- Keyword strategy alignment with business objectives

- Tool evaluation and optimization

Pro Tip: Create a keyword health score combining rankings, traffic, and conversions. Any keyword with declining health scores for 2+ consecutive quarters should be either re-optimized or removed from your priority list. Don’t waste resources on keywords that don’t deliver ROI.

How Does Multi-Market Keyword Research Work for Global Enterprises?

Multi-market keyword research introduces complexity that makes single-market research look like child’s play. You’re not just translating keywords—you’re researching completely different search behaviors across cultures and languages.

International Keyword Research Challenges

Language variations: Spanish spoken in Spain differs significantly from Mexican Spanish. Portuguese in Brazil isn’t the same as Portugal Portuguese. “Football” means soccer in most countries but American football in the US.

Search behavior differences: Germans prefer longer, more specific search queries. Americans use shorter queries. Cultural differences affect how people search for the same products.

Market maturity variations: Keywords showing high volume in mature markets (US, UK) might have minimal volume in emerging markets not because of low demand, but because the product category is still emerging.

Local competition levels: You might dominate “enterprise software” in Canada while facing brutal competition for the same keyword in the US market.

Framework for Enterprise International Keyword Strategy

Step 1: Native speaker research – Never rely solely on translation. Hire native SEO professionals or consultants for target markets. They understand local search nuances that translation misses.

Step 2: Local competitor analysis – Identify top local competitors and analyze their keyword strategies. What keywords drive their organic traffic? These reveal market-specific opportunities.

Step 3: Search volume validation – Verify keyword volume in specific markets using localized versions of keyword tools. Google Keyword Planner allows precise location targeting.

Step 4: Cultural customization – Adapt messaging to local cultural preferences. What works in one market might offend in another.

Step 5: Local search engine optimization – In markets where Google isn’t dominant (China with Baidu, Russia with Yandex), research platform-specific keyword behavior.

For comprehensive international SEO strategies beyond keyword research, explore Enterprise SEO for global markets covering hreflang implementation, content localization, and technical considerations.

Real-World Multi-Market Keyword Example

A global SaaS company launched in Germany by translating their US keyword strategy. “Cloud storage” became “Cloud-Speicher” (direct translation). Research showed Germans actually search for “Online-Speicher,” “Cloud-Backup,” and “Datenspeicherung” more frequently.

After pivoting to actual German search behavior, organic traffic increased 340% in 6 months. Translation isn’t research.

What Are Common Enterprise Keyword Research Mistakes to Avoid?

Let me save you from expensive mistakes I’ve watched enterprises make repeatedly.

Mistake #1: Prioritizing Search Volume Over Business Value

The keyword with 50,000 monthly searches looks impressive in reports. But if it has 5% organic CTR due to SERP features and converts at 0.1%, while a 3,000-volume keyword has 30% CTR and 2% conversion rate, which deserves priority?

How to avoid: Build prioritization models including click potential, conversion rates, and revenue value—not just search volume. Connect keywords to actual business outcomes.

Mistake #2: Keyword Cannibalization Across Enterprise Properties

Different teams targeting identical keywords creates internal competition. Your brand site competes against your product site competes against your blog—all fighting for the same keyword instead of working together.

According to Moz, keyword cannibalization can reduce overall organic traffic by 20-40% as Google struggles to determine which page to rank, often choosing neither.

How to avoid: Implement keyword mapping strategy with clear ownership. One URL per primary keyword across your entire domain portfolio.

Mistake #3: Ignoring Search Intent Misalignment

You’re ranking #3 for a keyword driving tons of traffic but zero conversions. Investigation reveals it’s an informational query but your page is pure product promotion. Intent mismatch kills conversion rates.

How to avoid: Analyze current SERPs for target keywords. What type of content ranks? Blog posts? Product pages? Comparisons? Match content type to dominant SERP intent.

Mistake #4: Static Keyword Research That Never Updates

Your enterprise conducted comprehensive keyword research in 2022 and hasn’t updated since. Markets evolve, competitors adapt, new products launch, search behavior shifts—but your keyword strategy remains frozen in time.

How to avoid: Establish quarterly keyword review cycles updating priorities based on performance data, market changes, and new opportunities.

Mistake #5: Neglecting Long-Tail Keyword Opportunities

Enterprises often focus exclusively on high-volume head terms while ignoring long-tail keywords. Those 10,000 long-tail keywords with 50-200 searches each? Combined, they drive more traffic than your top 50 head terms—often with better conversion rates.

How to avoid: Balance portfolio with 20-30% head terms, 30-40% mid-tail, and 30-40% long-tail keywords. Long-tail keywords typically have lower competition and higher conversion rates.

Mistake #6: Treating All Markets Identically

Applying your US keyword strategy to UK, Australia, Canada because “they all speak English” ignores significant search behavior differences. Spellings differ (color vs. colour), terminology varies (apartment vs. flat), and search volume distributions differ dramatically.

How to avoid: Conduct market-specific keyword research for every geographic expansion, even within the same language.

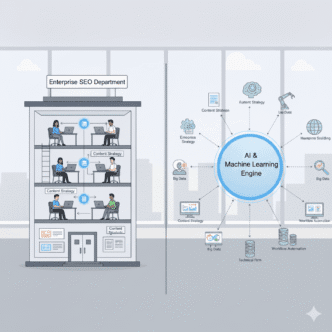

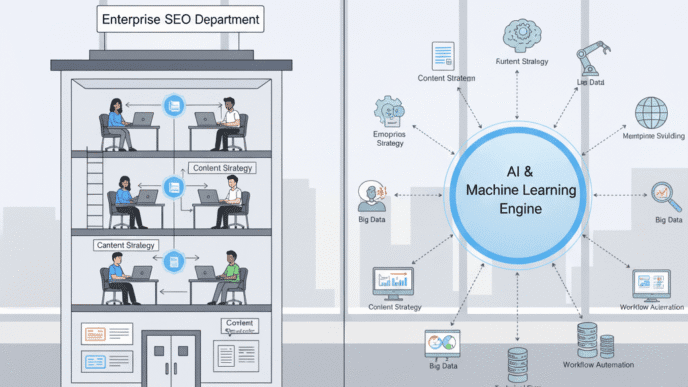

How Does AI Impact Enterprise Keyword Research Strategy?

AI and machine learning are fundamentally transforming enterprise keyword research, making previously impossible analysis now routine.

AI-Powered Keyword Research Capabilities

Automated keyword clustering using machine learning analyzes SERP overlap to group semantically related keywords. What took weeks of manual work now happens in minutes with 95%+ accuracy.

Predictive keyword opportunity scoring uses AI to forecast which keywords offer highest ROI based on your domain’s historical performance patterns. It learns which types of keywords you rank for easily versus which require heavy resources.

Natural language processing extracts keyword insights from unstructured data—customer service transcripts, sales calls, product reviews—identifying opportunities humans would miss.

Competitive intelligence automation continuously monitors competitor keyword changes, alerting when they gain or lose rankings on strategic terms. It learns patterns predicting competitor moves before they happen.

According to research by Gartner, organizations using AI for keyword research reduce research time by 60% while identifying 40% more opportunities compared to manual approaches.

AI Tools for Enterprise Keyword Research

MarketMuse uses AI to analyze content gaps and identify keyword opportunities based on topic comprehensiveness. It compares your content against top-ranking competitors, revealing missing semantic relationships.

Clearscope employs NLP to identify related terms and concepts search engines expect for comprehensive content targeting specific keywords.

BrightEdge Instant uses machine learning to provide real-time keyword recommendations based on content analysis, competitive landscape, and your domain’s authority.

Pro Tip: AI excels at pattern recognition and data processing but lacks business context. Use AI for heavy lifting—data analysis, clustering, opportunity identification—but apply human judgment when prioritizing based on strategic business objectives and resource constraints.

Real-World Enterprise Keyword Research Case Studies

Let’s examine how comprehensive keyword research strategies transformed enterprise organic performance.

Case Study #1: B2B SaaS Enterprise (Global Markets)

Challenge: Software company operating in 12 countries managed keywords reactively. Different regional teams pursued overlapping strategies with no coordination. Keyword portfolio grew to 63,000 tracked terms with no prioritization system.

Strategy Implementation:

- Conducted comprehensive keyword audit pruning portfolio to 18,000 strategic keywords

- Implemented keyword clustering grouping into 2,400 topic clusters

- Built prioritization model weighting business value, ranking difficulty, and market-specific opportunity

- Created keyword governance preventing duplicate targeting across regions

- Deployed Conductor platform for automated monitoring and performance tracking

Results After 12 Months:

- 215% increase in qualified organic leads

- 43% reduction in keyword research and management costs

- Captured #1 rankings for 67% of top-priority keywords

- $8.2M organic revenue attributed directly to strategic keyword targeting

- Reduced international keyword cannibalization by 89%

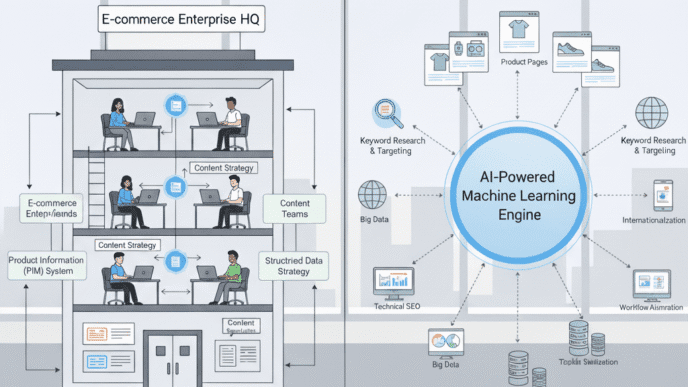

Case Study #2: E-Commerce Retailer (Multi-Category)

Challenge: Major retailer with 8 product categories operated in silos. Each category team independently researched keywords resulting in 73% duplication and internal competition. Product pages competed against each other in search results.

Strategy Implementation:

- Unified keyword research across categories eliminating duplicate efforts

- Implemented keyword mapping strategy assigning primary keywords to specific URLs

- Built category-specific keyword clusters optimized for e-commerce search intent

- Prioritized keywords by conversion value (revenue per keyword vs. pure traffic)

- Focused on long-tail product-specific keywords with higher conversion rates

Results After 9 Months:

- 167% increase in organic e-commerce revenue

- 52% improvement in organic conversion rate (better intent alignment)

- Reduced keyword cannibalization from 73% to 8%

- Identified 12,000 untapped long-tail opportunities competitors missed

- Improved organic margins by targeting higher-intent, lower-competition keywords

Case Study #3: Healthcare Network (Local + National)

Challenge: Healthcare organization with 250 locations struggled balancing national brand keywords against local service keywords. No systematic approach to multi-market keyword research across diverse geographic markets.

Strategy Implementation:

- Segmented keyword strategy into national brand terms vs. local service keywords

- Conducted location-specific keyword research for each major market

- Prioritized keywords based on service availability and competitive landscape by market

- Implemented schema markup supporting local keyword targeting

- Built automated monitoring tracking performance across 250 location-keyword combinations

Results After 10 Months:

- 290% increase in local organic appointment bookings

- Achieved top-3 local pack rankings for 83% of priority local service keywords

- National brand keywords increased visibility 156%

- \$4.7M cost savings versus paid search for equivalent visibility

- Organic channel became #1 patient acquisition source surpassing paid ads

These case studies demonstrate that strategic enterprise keyword research consistently delivers 150-300% performance improvements when properly implemented. For comprehensive frameworks on building enterprise SEO programs, keyword research must integrate with content strategy, technical optimization, and performance measurement.

Frequently Asked Questions About Enterprise Keyword Research

How many keywords should an enterprise track?

There’s no magic number, but most enterprises effectively manage 10,000-30,000 keywords. Beyond 50,000, you need sophisticated automation and dedicated resources. Quality over quantity—prioritize strategic keywords driving business outcomes rather than tracking everything possible.

Focus on keywords you’ll actually create content for or optimize existing content around. Tracking keywords with no action plan wastes resources.

How long does enterprise keyword research take?

Initial comprehensive research: 8-12 weeks for full enterprise implementation including strategy development, research, clustering, prioritization, and mapping.

Ongoing management: Dedicate 20-30% of one FTE for continuous keyword monitoring, quarterly reviews, and opportunity identification.

Market expansion research: 3-6 weeks per new market depending on complexity.

Rush the research and you’ll spend 6 months fixing strategic mistakes. Invest time upfront for long-term efficiency.

Should enterprises focus on head terms or long-tail keywords?

Both. Optimal enterprise keyword portfolio management balances:

- 20-30% high-volume head terms (brand visibility, competitive positioning)

- 30-40% mid-tail keywords (specific products/services)

- 30-40% long-tail keywords (conversion optimization, quick wins)

Long-tail keywords collectively drive more traffic and conversions than head terms while requiring fewer resources to rank.

How do you handle keyword cannibalization at enterprise scale?

Implement strict keyword mapping assigning each primary keyword to exactly one URL across your entire domain. Use tools like Ahrefs Site Audit or Semrush to identify existing cannibalization, then:

- Consolidate duplicate pages via 301 redirects

- Differentiate pages by adjusting keyword focus

- Use canonical tags if pages must remain separate

- Update internal linking to reinforce primary page for each keyword

What’s the difference between keyword clustering and keyword grouping?

Keyword grouping manually organizes keywords by topic or category based on human judgment.

Keyword clustering uses algorithms analyzing SERP overlap—if keywords show 60%+ ranking URL overlap, they’re clustered together because search engines consider them semantically related.

Clustering is more accurate at scale and reveals relationships humans might miss.

How do you prioritize keywords when everything seems important?

Build a quantitative scoring model combining:

- Business value (revenue potential, strategic importance)

- Opportunity (search volume, click potential)

- Difficulty (competition, ranking probability)

- Effort (resources required to rank)

Score each keyword, then prioritize top 20% for immediate focus. Review and adjust quarterly based on performance.

For guidance on building enterprise SEO prioritization frameworks, align keyword targeting with overall business objectives rather than chasing vanity metrics.

How often should enterprise keyword research be updated?

Continuous monitoring: Daily rank tracking for priority keywords, weekly for full portfolio

Monthly reviews: Performance analysis, quick-win identification, competitor movements

Quarterly updates: Prioritization adjustments, new opportunity research, strategy refinement

Annual comprehensive refresh: Full portfolio audit, competitive reassessment, strategic realignment

Markets evolve constantly—static keyword strategies become obsolete within 6-12 months.

Final Thoughts: Turning Keyword Chaos into Strategic Advantage

Here’s what separates enterprises winning at organic search from those drowning in keyword spreadsheets: They treat enterprise keyword research as a strategic business function, not a marketing task someone handles between meetings.

The companies dominating organic visibility in 2025 aren’t just researching more keywords—they’re building systematic frameworks connecting keywords to revenue, automating what can be automated, and ruthlessly prioritizing based on business impact rather than vanity metrics.

The Strategic Value of Enterprise Keyword Research

Proper enterprise keyword portfolio management isn’t about tracking every possible keyword. It’s about identifying the strategic subset of keywords that drive disproportionate business value, then allocating resources accordingly.

That means saying no to keywords stakeholders love but data proves won’t deliver ROI. It means investing heavily in unsexy long-tail keywords that competitors ignore but convert at 3x the rate of head terms.

According to comprehensive research by Search Engine Journal, enterprises with documented keyword strategies and governance frameworks achieve 4.1x higher organic ROI compared to organizations managing keywords reactively.

Building Sustainable Keyword Programs

One-time keyword research projects fail at enterprise scale. You need ongoing programs with:

- Dedicated ownership and clear accountability

- Systematic processes for research, prioritization, and mapping

- Automation handling routine monitoring and reporting

- Governance preventing duplicate efforts and internal competition

- Integration connecting keywords to content, technical SEO, and business goals

Your keyword research should be the foundation informing content strategy, technical optimization priorities, and enterprise SEO investment decisions across your organization.

The Bottom Line

Managing thousands of keywords isn’t about having bigger spreadsheets than competitors. It’s about having better systems, clearer priorities, and tighter connections between keywords and business outcomes.

The enterprise keyword research strategy gathering dust in your shared drive isn’t a reference document—it’s your roadmap to millions in additional organic revenue, more efficient resource allocation, and sustainable competitive advantage in organic search.

Stop managing keywords reactively. Start building strategic keyword programs that compound returns over years, not quarters.

Now close this article and audit your current keyword portfolio. I guarantee you’ll find opportunities worth 6-7 figures hiding in plain sight, waiting for someone to prioritize them strategically.