Table of Contents

Toggle

Executive Summary

Shopify has evolved from a simple online store builder in 2006 to the world’s leading commerce platform, powering over 4.6 million live stores across 175 countries as of 2025. This comprehensive intelligence report analyzes Shopify’s journey, market position, competitive landscape, and future trajectory in the global e-commerce ecosystem.

Key Findings:

- Shopify controls approximately 28% of the U.S. e-commerce platform market share

- Gross Merchandise Volume (GMV) exceeded $235 billion in 2023

- Platform supports over $444 billion in cumulative economic activity globally

- Powers stores in 175+ countries with 21 supported languages

- Over 8,000+ apps available in the Shopify App Store

Timeline: The Evolution of Shopify

2004-2006: The Origin Story

2004: Tobias Lütke, Daniel Weinand, and Scott Lake attempt to launch an online snowboard store called Snowdevil. Frustrated with existing e-commerce platforms, Lütke (a programmer) decides to build his own.

2006: Snowdevil pivots to become Shopify, launching as a hosted e-commerce platform. Initial focus: small businesses needing an easy way to sell online.

Tobias Lütke, Shopify CEO: “We didn’t set out to build an e-commerce company. We wanted to sell snowboards. The fact that we had to build the store first was just an obstacle we had to overcome.”

2007-2010: Early Growth Phase

2008: Shopify launches its API and App Store, allowing third-party developers to build integrations. This ecosystem approach becomes fundamental to Shopify’s success.

2009: Shopify reaches 8,000 stores on the platform. Raises $7 million in Series A funding.

2010: Launches free mobile apps for iPhone and Android, enabling merchants to manage stores on the go. Reaches 20,000+ stores.

2011-2015: Scaling and Innovation

2013: Introduces Shopify POS (Point of Sale), bridging online and offline retail. This omnichannel approach differentiates Shopify from online-only competitors.

2014: Acquires mobile shopping app Boltmade, signaling commitment to mobile commerce.

2015:

- May 21: Shopify goes public on NYSE and Toronto Stock Exchange, raising $131 million at $17 per share

- Launches Shopify Plus for enterprise clients

- Merchant count exceeds 175,000 stores

Key Milestone: IPO valued Shopify at approximately $1.27 billion. The stock price would grow over 120x in the following 6 years.

2016-2019: Enterprise Push and Global Expansion

2016:

- Introduces Shopify Capital, offering merchant financing

- Launches Shopify Payments in multiple new countries

- Partners with Amazon to enable selling on Amazon directly from Shopify

2017:

- Reaches 500,000+ merchants

- Introduces augmented reality (AR) features for product visualization

- Launches Shopify Fulfillment Network plans

2018:

- Acquires 6 River Systems for $450 million to power fulfillment network

- Merchant count exceeds 800,000

- GMV surpasses $41 billion

2019:

- Introduces Shopify Email marketing tool

- Launches Shop app (formerly Arrive) for order tracking

- Announces Shopify Fulfillment Network beta

2020-2021: Pandemic Boom and Acceleration

2020:

- COVID-19 Impact: E-commerce adoption accelerates by 5+ years in months

- Black Friday 2020: Shopify merchants generate $5.1 billion in sales, up 76% from 2019

- Reaches 1.7 million+ merchants

- Stock price surges 170% during the year

- GMV grows to $119.6 billion (up from $61.1 billion in 2019)

2021:

- Peak Market Cap: Shopify reaches $180+ billion valuation, becoming Canada’s most valuable company

- Acquires fulfillment technology company Deliverr for $2.1 billion

- Introduces Shopify Markets for international selling

- Launches Shop Pay Installments (buy now, pay later)

- Black Friday 2021: $6.3 billion in sales

Harley Finkelstein, Shopify President: “The pandemic didn’t just accelerate e-commerce adoption; it fundamentally changed consumer behavior forever. What would have taken five years happened in five months.”

2022-2023: Market Correction and Refocusing

2022:

- Market Reality Check: Stock price falls 75% from peak as tech sector corrects

- July 2022: Lays off 10% of workforce (~1,000 employees) as pandemic growth normalizes

- Divests logistics business (6 River Systems, Deliverr) to Flexport, refocusing on core platform

- Introduces Shopify Editions (regular product launch events)

- GMV reaches $197 billion

2023:

- May 2023: Second round of layoffs (20% of workforce) to streamline operations

- Introduces native B2B commerce features

- Launches Shopify Magic (AI-powered tools) including AI content generation

- Expands Shopify Collective (B2B network for retailers)

- Partners with YouTube for integrated shopping

- GMV exceeds $235 billion

2024-2025: AI Integration and Platform Maturity

2024:

- Introduces Sidekick (AI business assistant)

- Enhances Shopify Magic with GPT-4 integration

- Expands Shop Pay to more merchants

- Strengthens point-of-sale systems

- Focuses on profitability over growth-at-all-costs

2025 (Current):

- Over 4.6 million live stores globally

- Platform powers approximately $500+ billion in annual GMV (projected)

- Increased focus on AI-powered commerce tools

- Enhanced mobile commerce capabilities

- Expansion of enterprise (Shopify Plus) offerings

Market Position Analysis

Global E-commerce Platform Market Share

| Platform | U.S. Market Share | Global Presence | Primary Strength |

|---|---|---|---|

| Shopify | 28% | 175+ countries | Ease of use, ecosystem, scalability |

| WooCommerce | 23% | Global (WordPress plugin) | Flexibility, open-source |

| Wix | 12% | Global | All-in-one website + e-commerce |

| Squarespace | 8% | North America, Europe | Design-focused, integrated |

| BigCommerce | 3% | Global | Enterprise features |

| Adobe Commerce (Magento) | 2% | Global | High customization, enterprise |

| Others | 24% | Various | Niche solutions |

Source: BuiltWith, Statista, 2024 data

Key Performance Metrics

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 (Est.) |

|---|---|---|---|---|---|

| Merchants | 1.7M | 2.1M | 3.8M | 4.4M | 4.9M |

| GMV | $119.6B | $175.4B | $197B | $235B | $275B |

| Revenue | $2.93B | $4.61B | $5.6B | $7.1B | $8.5B |

| Shopify Plus Merchants | Not disclosed | 11,000+ | 17,000+ | 25,000+ | 30,000+ |

Source: Shopify Investor Relations, company reports

Geographic Distribution

Top 5 Countries by Merchant Count:

- United States: ~2.3 million stores (50%)

- United Kingdom: ~480,000 stores (10.4%)

- Australia: ~230,000 stores (5%)

- Canada: ~190,000 stores (4.1%)

- Germany: ~150,000 stores (3.3%)

Competitive Landscape Analysis

Shopify vs. Major Competitors

Shopify vs. WooCommerce

| Factor | Shopify | WooCommerce |

|---|---|---|

| Hosting | Hosted (all-in-one) | Self-hosted (WordPress) |

| Ease of Use | ⭐⭐⭐⭐⭐ Very easy | ⭐⭐⭐ Moderate (requires WordPress knowledge) |

| Pricing | $39-$399/mo (Plus custom) | Free plugin + hosting ($5-100+/mo) |

| Customization | ⭐⭐⭐⭐ High (within ecosystem) | ⭐⭐⭐⭐⭐ Unlimited (open source) |

| Scalability | ⭐⭐⭐⭐⭐ Excellent | ⭐⭐⭐ Depends on hosting |

| Apps/Extensions | 8,000+ apps | 50,000+ WordPress plugins |

| Best For | Growing businesses, ease of use | Developers, existing WordPress sites |

Expert Opinion – Neil Patel, Digital Marketing Expert: “Shopify wins on simplicity and reliability. WooCommerce wins on flexibility and cost. Choose Shopify if you want to sell quickly without technical headaches. Choose WooCommerce if you need complete control and have developer resources.”

Shopify vs. BigCommerce

| Factor | Shopify | BigCommerce |

|---|---|---|

| Market Position | Market leader | Enterprise challenger |

| Built-in Features | ⭐⭐⭐⭐ Good | ⭐⭐⭐⭐⭐ More comprehensive |

| Transaction Fees | 0.5-2% (if not using Shopify Payments) | None |

| Multi-channel | ⭐⭐⭐⭐⭐ Excellent | ⭐⭐⭐⭐ Good |

| App Ecosystem | 8,000+ apps | 1,000+ apps |

| Pricing | $39-$399/mo | $39-$399/mo |

| Best For | Most businesses, ecosystem strength | Large catalogs, no transaction fees |

Shopify vs. Amazon

Different Business Models:

- Amazon: Marketplace model (sellers use Amazon’s platform, Amazon controls customer relationship)

- Shopify: Enable merchants to build their own branded stores

Complementary Relationship: Many Shopify merchants also sell on Amazon. Shopify offers Amazon channel integration.

Key Difference: Shopify empowers brand ownership; Amazon provides massive reach but less brand control.

Shopify’s Strategic Position: “We arm the rebels against the empire.” – Tobias Lütke on competing with Amazon by enabling independent merchants.

Shopify’s Business Model Deep Dive

Revenue Streams

1. Subscription Solutions (33% of revenue)

- Basic Shopify: $39/month

- Shopify: $105/month

- Advanced Shopify: $399/month

- Shopify Plus: Custom pricing ($2,000-40,000+/month)

2. Merchant Solutions (67% of revenue)

- Shopify Payments (payment processing fees)

- Shopify Shipping (discounted shipping labels)

- Shopify Capital (merchant lending)

- Transaction fees (for non-Shopify Payments users)

- App revenue share

- POS hardware sales

- Theme and app sales (commission)

Economic Moat and Competitive Advantages

1. Network Effects

- More merchants → More app developers → Better platform → More merchants

- 8,000+ apps create powerful ecosystem lock-in

2. Switching Costs

- Merchants invest heavily in customization, apps, data

- Switching platforms is technically difficult and risky

- Historical data, customer relationships tied to platform

- “Powered by Shopify” badge signals legitimacy

- Trusted by 4.6M+ merchants globally

- Enterprise clients (Heinz, Gymshark, Allbirds) validate platform

4. Economies of Scale

- Infrastructure costs spread across millions of merchants

- Negotiating power with payment processors

- Can invest heavily in R&D, security, compliance

Success Stories and Case Studies

Case Study 1: Gymshark

Background: UK-based fitness apparel brand founded in 2012

Shopify Impact:

- Started on Shopify, scaled to $500M+ annual revenue

- Leveraged Shopify Plus for global expansion

- Utilized Shopify’s multi-channel capabilities

- Peak traffic handling: 100,000+ concurrent visitors during launches

Result: Became one of fastest-growing fitness brands, valued at $1.3B+ in 2020

Ben Francis, Gymshark Founder: “Shopify gave us the infrastructure to scale globally without needing to build a massive tech team. We could focus on product and community.”

Case Study 2: Allbirds

Background: Sustainable footwear company launched in 2016

Shopify Journey:

- Direct-to-consumer model powered by Shopify

- Grew from startup to IPO (2021) on the platform

- Expanded to 35+ physical stores using Shopify POS

- Seamless omnichannel experience

Result: Reached $1B+ valuation, went public in 2021 (though stock struggled post-IPO)

Case Study 3: Fashion Nova

Background: Fast fashion e-commerce brand

Scale on Shopify:

- Generates $400M-800M annual revenue (estimated)

- Handles massive traffic spikes from influencer collaborations

- Leveraged Shopify’s scalability during viral moments

- Rapid product launches enabled by platform flexibility

Case Study 4: Heinz (Enterprise Adoption)

Background: 150+ year old CPG giant

Shopify Plus Implementation:

- Launched direct-to-consumer stores in multiple countries

- Created custom product configurator (build-your-own ketchup bottle)

- Integrated with existing enterprise systems

- Tested new markets and products quickly

Significance: Demonstrates Shopify Plus can serve even traditional large enterprises

Key Statistics and Data Points

Platform Statistics (2024-2025)

Merchant Success Metrics:

- Average annual revenue per Shopify store: $63,000 (varies widely by plan and industry)

- Store survival rate: Approximately 55% of stores still active after 1 year

- Mobile commerce: 71% of Shopify traffic comes from mobile devices

- Conversion rate average: 1.6% across all Shopify stores (industry average)

Shopify Payments Adoption:

- Used by approximately 60% of Shopify merchants

- Available in 18+ countries

- Supports 100+ currencies

App Store Ecosystem:

- 8,000+ apps available

- Top apps generate $10M+ annual revenue

- Average merchant uses 6-10 apps

Black Friday/Cyber Monday Performance:

- 2023: Shopify merchants generated $9.3 billion in sales over BFCM weekend

- Peak: $4.2 million in sales per minute

- 61% of orders made on mobile devices

Industry Benchmarks by Vertical

| Industry | Avg. Conversion Rate | Avg. Order Value | Top Traffic Source |

|---|---|---|---|

| Fashion/Apparel | 1.4% | $75 | Instagram, Google |

| Beauty/Cosmetics | 1.8% | $62 | Instagram, TikTok |

| Home & Garden | 1.2% | $95 | Pinterest, Google |

| Electronics | 0.9% | $180 | Google, Facebook |

| Food & Beverage | 1.5% | $58 | Facebook, Google |

| Health/Wellness | 2.1% | $85 | Google, YouTube |

Source: Shopify merchant data, Littledata benchmarks 2024

Economic Impact

Statistic: Shopify’s platform has enabled over $444 billion in cumulative global economic activity since inception, supporting millions of jobs worldwide.

Job Creation:

- Each Shopify merchant employs an average of 2.1 people

- Estimated 10+ million jobs supported by Shopify ecosystem

- App developer economy generates $1B+ annually

Technology and Innovation

AI and Machine Learning Integration

Shopify Magic (Launched 2023)

- AI-powered product descriptions

- Image background removal

- Email subject line optimization

- Content generation for marketing

Sidekick (Announced 2023)

- AI-powered business assistant

- Natural language interface for complex tasks

- Data analysis and insights

- Predictive analytics for inventory and demand

Shop App Personalization

- Machine learning powers personalized product recommendations

- 140+ million registered users

- AI-driven shopping discovery

Mobile Commerce Innovation

Shop Pay

- One-tap checkout for returning customers

- Stores payment information securely

- 50M+ consumers have used Shop Pay

- 65% faster checkout than standard process

Mobile Optimization

- Mobile-first design philosophy

- Progressive Web App (PWA) capabilities

- Native mobile apps for iOS and Android

Augmented Reality (AR)

AR Shopping Features:

- 3D product visualization

- Try-before-you-buy experiences

- Reduces return rates by 40% (reported by merchants using AR)

- Supports glTF and USDZ 3D model formats

Challenges and Criticisms

Major Challenges Facing Shopify

1. Market Saturation Concerns

- Issue: U.S. and Canadian markets approaching saturation

- Response: International expansion focus, B2B commerce push

2. Dependence on Consumer Spending

- Issue: E-commerce growth tied to economic conditions

- Impact: 2022-2023 slowdown as pandemic boom normalized

3. Competitive Pressure

- From Below: Low-cost platforms (Wix, Squarespace) competing on price

- From Above: Enterprise solutions (Adobe Commerce, Salesforce Commerce Cloud)

- From Sides: Niche players (Kajabi for creators, Podia for courses)

4. Merchant Churn

- Reality: Many stores fail within first year

- Industry Standard: ~50% of e-commerce businesses fail within 5 years

- Shopify’s Approach: Focus on education, tools, and support

5. App Ecosystem Quality Control

- Issue: Some apps provide poor experiences or overlap functionality

- Criticism: App costs can exceed Shopify subscription cost

- Response: Improved app review process, featured app curation

Criticism from Merchants

“App Fatigue”

Common Complaint: “I pay $105/month for Shopify, but need to spend another $200/month on apps for features that should be built-in.”

Shopify’s Defense: Ecosystem approach allows best-of-breed solutions vs. bloated all-in-one platform

Transaction Fees

- Issue: 0.5-2% transaction fee if not using Shopify Payments

- Merchant Perspective: Feels like penalty for using preferred payment processor

- Industry Context: Standard practice, but frustrating nonetheless

Expert Criticisms

Criticism from Developers: “Liquid templating language is limiting compared to modern frameworks. Shopify’s focus on ease of use sometimes sacrifices flexibility for advanced users.”

Response from Shopify: Ongoing improvements to theme development (Online Store 2.0), better APIs, and headless commerce options address some concerns.

Future Outlook and Predictions

2025-2027 Strategic Priorities

1. AI-First Commerce

- Deeper AI integration across platform

- Automated business optimization

- Predictive analytics for inventory, pricing, marketing

- Conversational commerce (chatbots, voice commerce)

2. B2B Commerce Expansion

- Shopify traditionally focused on B2C

- B2B market is $6.7 trillion (vs. B2C $4.9 trillion in U.S.)

- Competitive opportunity against Salesforce, SAP

3. International Growth

- Focus on emerging markets (India, Southeast Asia, Latin America)

- Localized payment methods and fulfillment

- Multi-currency and multi-language improvements

4. Enterprise Market Penetration

- Shopify Plus competing against Adobe Commerce, Salesforce

- Winning traditional retailers moving online

- Advantage: Faster implementation, lower cost, better UX

5. Social Commerce Integration

- Deeper TikTok, Instagram, YouTube shopping

- Live commerce (already huge in Asia)

- Influencer/creator commerce tools

Market Predictions

Analyst Forecasts (2025-2027):

| Metric | 2025 (Projected) | 2027 (Projected) |

|---|---|---|

| Total Merchants | 5.2 million | 6.5+ million |

| GMV | $300+ billion | $400+ billion |

| Annual Revenue | $9-10 billion | $13-15 billion |

| Market Share (U.S.) | 30% | 32-35% |

Source: Analyst estimates from Morgan Stanley, Goldman Sachs

Analyst Opinion – Mark Mahaney, Evercore ISI: “Shopify remains the best-positioned pure-play e-commerce platform. The network effects are real, the ecosystem is unmatched, and the total addressable market is still in early innings globally.”

Potential Disruptors and Risks

1. Economic Recession

- Consumer spending directly impacts merchant success

- Potential merchant churn during downturn

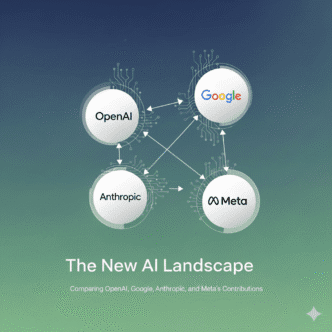

2. Big Tech Competition

- Google, Amazon, Meta all have commerce ambitions

- Could leverage existing user bases

3. Regulatory Challenges

- Payment processing regulations

- Data privacy laws (GDPR, CCPA)

- Cross-border commerce complexity

4. Technology Shifts

- Web3/blockchain commerce

- Decentralized platforms

- AI-native commerce platforms

Expert Opinions and Analysis

Industry Expert Perspectives

Andrew Lipsman, Principal Analyst at Insider Intelligence: “Shopify has successfully positioned itself as the anti-Amazon, empowering merchants to own their customer relationships and brand identity. This positioning resonates strongly with mid-market and enterprise brands tired of competing in Amazon’s marketplace.”

Stephanie Wissink, Managing Director at Jefferies: “Shopify’s pivot away from fulfillment back to core platform was the right strategic move. They’re not trying to be Amazon. They’re enabling millions of mini-Amazons to thrive independently.”

Benedict Evans, Technology Analyst: “The question isn’t whether Shopify can compete with Amazon—they’re playing a different game entirely. Shopify is infrastructure. They’re the Stripe of e-commerce platforms. That’s a much more defensible position.”

Merchant Testimonials

Small Business Owner (5-figure annual revenue): “Shopify let me launch my first product in 2 weeks without touching code. Three years later, I’m doing $300K annually and still on the same platform because it scales with me.”

Mid-Market Brand ($5M+ revenue): “We migrated from WooCommerce to Shopify Plus. The uptime, speed, and peace of mind is worth every penny. Our dev team can focus on growth, not keeping the lights on.”

Enterprise Merchant: “Shopify Plus gives us 90% of what we need out of the box. The last 10% we customize. Compare that to Magento where we had to custom-build 60% of functionality. Time to market is dramatically faster.”

Developer Community Perspective

Shopify Partner Agency Owner: “The Shopify Partner program is one of the most lucrative ecosystems for agencies. We build stores for clients, develop apps, and create themes—all recurring revenue streams. Shopify’s success directly drives our success.

App Developer (7-figure app revenue): “Shopify’s App Store is like the early days of the iOS App Store. If you solve a real merchant problem well, you can build a massive business. The merchant base is huge and growing.”

Actionable Insights and Recommendations

For Prospective Merchants

✅ Choose Shopify If:

- You want to launch quickly (days/weeks, not months)

- You value ease of use over ultimate flexibility

- You need reliable, scalable infrastructure

- You want access to extensive app ecosystem

- You plan to sell across multiple channels

- You’re willing to invest in apps for advanced features

❌ Consider Alternatives If:

- You need ultimate customization (consider WooCommerce)

- You’re on extremely tight budget (consider free platforms initially)

- You have complex, unusual business model (might need custom solution)

- You already have WordPress site (WooCommerce might integrate better)

For Current Shopify Merchants

📈 Growth Optimization Tips:

1. Master Multi-Channel Selling

- Connect Instagram, Facebook, TikTok, Pinterest

- List on Google Shopping

- Consider Amazon channel for additional reach

2. Optimize Shopify Apps

- Audit monthly: Remove unused apps

- Target: 5-10 essential apps maximum

- Monitor app impact on site speed

3. Leverage Shopify’s Native Features

- Use Shopify Email (free for first 10,000 emails/month)

- Implement Shopify Payments (avoid transaction fees)

- Utilize Shop app for customer loyalty

4. International Expansion

- Use Shopify Markets for multi-currency, multi-language

- Implement proper international SEO (hreflang tags)

- Localize payment methods and shipping

5. Mobile Optimization Priority

- 71% of traffic is mobile

- Test checkout on actual devices monthly

- Optimize images for mobile load speed

For Enterprise Consideration

Shopify Plus Evaluation Criteria:

| Factor | Evaluation Question | Shopify Plus Strength |

|---|---|---|

| Speed to Market | How quickly do we need to launch? | ⭐⭐⭐⭐⭐ 3-6 months typical |

| Total Cost | What’s our 3-year TCO? | ⭐⭐⭐⭐ Lower than most enterprise |

| Scalability | Can it handle our traffic? | ⭐⭐⭐⭐⭐ Handles billions in GMV |

| Customization | Do we need deep customization? | ⭐⭐⭐⭐ Good (not unlimited) |

| Integrations | Connect to our existing systems? | ⭐⭐⭐⭐ APIs + app ecosystem |

| Support | Do we need dedicated support? | ⭐⭐⭐⭐⭐ Dedicated account manager |

When Shopify Plus Makes Sense:

- You’re doing $1M+ annual revenue (general guideline)

- You need 99.99% uptime SLA

- You want dedicated support and account management

- You value speed to market over customization depth

- You’re scaling internationally

Frequently Asked Questions (FAQs)

General Questions

Q: Is Shopify suitable for beginners with no technical knowledge?

A: Yes. Shopify is designed specifically for non-technical users. You can launch a functional store in hours without coding. The platform handles hosting, security, updates, and infrastructure. If you can use WordPress or basic website builders, you can use Shopify.

Q: What’s the true cost of running a Shopify store?

A: Minimum: $39/month (Basic plan) + $0 (free theme) + $0-50/month (essential apps) = $39-89/month. Realistic: $105/month (Shopify plan) + $50-200/month (apps) + transaction fees = $155-305/month plus payment processing fees (2.4-2.9% + 30¢ per transaction).

Q: Can Shopify scale from startup to enterprise?

A: Yes. Shopify powers stores doing $100/month and stores doing $100M+/year on the same core platform. Shopify Plus handles enterprise needs. Companies like Heinz, Gymshark, and Fashion Nova operate on Shopify successfully.

Q: How long does it take to launch a Shopify store?

A:

- Basic store: 1-3 days (using free theme, minimal customization)

- Professional store: 2-4 weeks (custom design, app integration, content creation)

- Enterprise (Shopify Plus): 3-6 months (complex integrations, custom development)

Business Model Questions

Q: Can I use Shopify for services, not just physical products?

A: Yes, but it’s primarily optimized for products. You can sell:

- Services (consultations, memberships)

- Digital products (courses, ebooks, downloads)

- Bookings/appointments (with apps)

- Subscriptions (with apps)

For purely service-based businesses, specialized platforms might be better.

Q: Does Shopify take a percentage of my sales?

A: Not directly. You pay:

- Monthly subscription fee ($39-399+ depending on plan)

- Payment processing fees (2.4-2.9% + 30¢ per transaction via Shopify Payments)

- Transaction fee (0.5-2% if using external payment processor instead of Shopify Payments)

Q: Can I migrate from another platform to Shopify?

A: Yes. Shopify offers migration tools and apps for transferring:

- Products and variants

- Customer data

- Order history (limited)

- Blog posts

Migrations typically take 1-4 weeks depending on store size and complexity.

Technical Questions

Q: Do I need to know how to code to use Shopify?

A: No for basic use. Yes for advanced customization.

- No coding needed: Use theme customizer, apps, Shopify’s built-in features

- Basic HTML/CSS helpful: For minor design tweaks

- Liquid, JavaScript needed: For deep theme customization

Most merchants never touch code; they hire Shopify Experts or use apps instead.

Q: Can I use my own domain name with Shopify?

A: Yes. You can either:

- Buy domain through Shopify ($11-14/year)

- Transfer existing domain to Shopify

- Keep domain with current registrar and point DNS to Shopify (most common)

Your store won’t be “yourstore.myshopify.com”—it’ll be “yourstore.com”

Q: Is Shopify SEO-friendly?

A: Yes, with caveats:

- Good: Clean URLs, mobile-optimized, fast hosting, automatic sitemaps, proper schema markup

- Limitations: URL structure is /collections/product-name (can’t remove /collections), limited blogging features compared to WordPress

- Verdict: SEO-capable, but requires optimization work like any platform

Q: Can I sell internationally on Shopify?

A: Yes. Shopify Markets enables:

- Multi-currency pricing

- Multi-language stores

- Localized domains or subfolders

- Region-specific pricing and tax calculation

- International shipping and duties

Supports 175+ countries and 20+ languages.

Comparison Questions

Q: Shopify vs. Etsy—which is better?

A: Different purposes:

- Etsy: Marketplace for handmade/vintage (like eBay for crafts). Lower effort to start, built-in audience, but less control and Etsy takes large fees.

- Shopify: Your own independent store. More control, own your customers, keep more profit, but requires driving your own traffic.

Many sellers use both: Etsy for initial sales, Shopify for building own brand.

Q: Can Shopify compete with custom-built solutions?

A: For most businesses, yes. Custom-built stores cost $50,000-500,000+ and take 6-18 months. Unless you have very unique requirements or are doing $100M+ annually with specific needs, Shopify Plus is usually more cost-effective and faster.

Success and Strategy Questions

Q: What percentage of Shopify stores succeed?

A: Approximately 5-10% of e-commerce businesses reach significant success (definition varies). This isn’t a Shopify problem—it’s an e-commerce reality. Most fail due to:

- Lack of traffic/marketing

- Poor product-market fit

- Insufficient funding

- Inadequate business planning

Platform choice matters less than business fundamentals.

Q: How much money can you make with a Shopify store?

A: Highly variable:

- Average Shopify store: ~$63,000/year in revenue

- Median (50th percentile): Much lower (~$15,000-25,000/year)

- Top 10%: $500,000+ per year

- Top 1%: $10M+ per year

- Success stories: Some reach $100M+ (Gymshark, Fashion Nova, Allbirds)

Revenue doesn’t equal profit. Average e-commerce profit margins: 5-20% depending on industry and business model.

Q: What’s the best way to drive traffic to a Shopify store?

A: Multi-channel approach works best:

Paid Channels (Fast but expensive):

- Facebook/Instagram Ads (most common for e-commerce)

- Google Ads (Shopping + Search)

- TikTok Ads (growing rapidly)

- Influencer partnerships

Organic Channels (Slow but sustainable):

- SEO (blog content, product optimization)

- Social media (organic Instagram, Pinterest, TikTok)

- Email marketing (highest ROI for retention)

- Content marketing (guides, resources)

Hybrid:

- Affiliate marketing

- Brand partnerships

- PR and media coverage

- Referral programs

Pro Tip: Most successful stores use 3-5 traffic sources. Relying on one channel (e.g., only Facebook Ads) is risky.

Strategic Recommendations by Business Stage

For Pre-Launch (Idea Stage)

Critical Steps:

Validate demand before building

- Run Facebook Ads to landing page

- Survey target audience

- Analyze search volume for keywords

- Study successful competitors

Choose right starting plan

- Most should start with Shopify plan ($105/mo), not Basic

- Reason: Lower credit card fees pay for upgrade quickly

- Basic only if under 50 transactions/month

Budget realistically

- Platform: $105-399/month

- Apps: $50-200/month

- Marketing: $500-5,000/month (minimum to see traction)

- Inventory: Varies by model

- Total Year 1: $10,000-50,000+ investment typical

Start with MVP (Minimum Viable Product)

- Free or inexpensive theme initially

- Essential apps only (5 maximum)

- Small initial product line (5-20 SKUs)

- Scale complexity as revenue grows

For Launch Phase (0-6 Months)

Priorities:

Conversion Rate Optimization (CRO)

- Professional product photography

- Clear product descriptions

- Trust signals (reviews, guarantees, security badges)

- Mobile optimization

- Fast checkout process

Traffic Generation

- Start with paid ads (faster feedback)

- Build email list from day one

- Content marketing for SEO foundation

- Leverage personal network

Customer Experience

- Respond to inquiries within hours

- Over-deliver on shipping speed

- Follow up post-purchase

- Request reviews from happy customers

- Website traffic

- Conversion rate

- Average order value (AOV)

- Customer acquisition cost (CAC)

- Return on ad spend (ROAS)

Benchmark Goals:

- Month 1-3: $1,000-5,000 revenue

- Month 4-6: $5,000-20,000 revenue

- Conversion rate: 1-2%

- Break-even on marketing spend

For Growth Phase (6-24 Months)

Scale Tactics:

Diversify Traffic Sources

- If Facebook Ads working: Add Google, TikTok

- Double down on organic (SEO, content)

- Build email marketing automation

- Explore affiliates and partnerships

Optimize Unit Economics

- Increase AOV through bundling, upsells

- Reduce CAC through better targeting

- Improve conversion rate (target 2-3%)

- Reduce return rate

Operational Scaling

- Consider 3PL (third-party logistics) if doing 100+ orders/week

- Automate repetitive tasks

- Hire first employees/contractors

- Implement inventory management systems

International Expansion

- Start with Canada, UK, Australia (English-speaking)

- Use Shopify Markets for multi-currency

- Test with ads before full localization

Benchmark Goals:

- Month 12: $50,000-200,000 monthly revenue

- Month 24: $100,000-500,000 monthly revenue

- Profit margin: 15-25%

- Team: 2-10 people

For Maturity Phase ($1M+ Annual Revenue)

Enterprise Considerations:

Evaluate Shopify Plus

- Justified at $1M+ annual revenue typically

- Benefits:

- Unlimited staff accounts

- Advanced automation (Shopify Flow)

- Wholesale channel (B2B)

- Exclusive APIs

- Dedicated account manager

- Cost: $2,000-40,000+/month depending on GMV

Advanced Marketing

- Build brand partnerships

- Invest in PR and content marketing

- Create affiliate/influencer programs

- Develop subscription/membership models

- Explore wholesale opportunities

Technology Stack Optimization

- Consider headless commerce if needed

- Enterprise resource planning (ERP) integration

- Advanced analytics and attribution

- Marketing automation platforms

Team and Organization

- Dedicated marketing team

- Customer service team

- Operations/fulfillment manager

- Specialized roles (SEO, PPC, email marketing)

Industry Vertical Analysis: Shopify Performance by Niche

Best Performing Verticals on Shopify

1. Fashion and Apparel

- Market Share: Largest category (~25% of Shopify stores)

- Average Success Rate: Moderate (high competition)

- Why It Works: Visual products, social media marketing synergy, repeat purchase potential

- Challenges: Sizing issues, high return rates, intense competition

- Success Examples: Gymshark, Fashion Nova, Outdoor Voices

2. Health, Beauty, and Cosmetics

- Market Share: ~15% of stores

- Average Success Rate: High (good margins, loyal customers)

- Why It Works: Consumable products, subscription potential, influencer marketing effectiveness

- Challenges: Regulatory compliance, ingredient transparency expectations

- Success Examples: Kylie Cosmetics, Glossier (before platform change), ColourPop

3. Home and Garden

- Market Share: ~12% of stores

- Average Success Rate: Moderate to High

- Why It Works: Higher AOV, Pinterest marketing effectiveness, growing market

- Challenges: Shipping costs for bulky items, seasonal demand

- Success Examples: Allbirds (home goods line), Burrow, Article

4. Food and Beverage

- Market Share: ~8% of stores

- Average Success Rate: Moderate (niche-dependent)

- Why It Works: Subscription model potential, passion category, COVID boost

- Challenges: Perishability, shipping complexity, regulations

- Success Examples: Death Wish Coffee, Omsom, Magic Spoon

5. Electronics and Gadgets

- Market Share: ~7% of stores

- Average Success Rate: Moderate (high competition from Amazon)

- Why It Works: High AOV, male-dominated market (easier Facebook Ads targeting)

- Challenges: Amazon competition, warranty/support expectations, thin margins

- Success Examples: MVMT Watches, Ridge Wallet, Anker (multi-platform)

Emerging Opportunities on Shopify

1. Sustainable/Eco-Friendly Products

- Growing consumer demand (especially Gen Z, Millennials)

- Premium pricing justified by values alignment

- Strong storytelling and brand differentiation potential

2. Personalized/Custom Products

- Print-on-demand integration with Shopify

- Low inventory risk

- Higher perceived value, better margins

3. Digital Products and Memberships

- Zero shipping costs and complexity

- Scalable with minimal marginal costs

- Works well with Shopify’s subscription apps

4. B2B Commerce

- Shopify’s emerging focus area

- Large untapped market ($6.7T in U.S.)

- Wholesale functionality improving rapidly

Risk Analysis and Mitigation Strategies

Business Risks for Shopify Merchants

Risk Likelihood Impact Mitigation Strategy Platform Dependency High High Diversify with other sales channels (Amazon, eBay, own app) Algorithm Changes (Facebook/Instagram) High High Build owned audience (email list, SMS) Rising Ad Costs High Medium Focus on organic channels (SEO, content, social) Economic Recession Medium High Focus on essential products, flexible pricing, strong retention Supply Chain Disruption Medium High Multiple suppliers, domestic options, safety stock Shopify Price Increases Medium Low Budget for 5-10% annual increases Payment Processing Issues Low High Have backup payment processor configured Account Suspension Low Critical Follow TOS strictly, have account backup plan Platform-Specific Risks

Shopify Account Suspension

Common Causes:

- Selling prohibited products (weapons, tobacco, pharma without license)

- High chargeback rate (over 1%)

- Fraudulent activity

- Terms of Service violations

Prevention:

- Read and follow Shopify Acceptable Use Policy

- Implement fraud detection tools

- Provide excellent customer service (reduces chargebacks)

- Have clear product descriptions (reduces disputes)

- Respond quickly to Shopify compliance inquiries

App Ecosystem Risks

Potential Issues:

- App abandonment (developer stops updating)

- App conflicts causing site issues

- Data security concerns with third-party apps

- Rising app costs over time

Best Practices:

- Vet apps thoroughly (reviews, update frequency, developer reputation)

- Audit apps quarterly

- Have backup options for critical functionality

- Use official Shopify apps when available

Future Technologies and Trends

Emerging Technologies Impacting Shopify Ecosystem

1. Artificial Intelligence and Machine Learning

Current State:

- Shopify Magic for content generation

- Sidekick AI assistant (in development)

- Shop app personalization

Future Trajectory (2025-2027):

- AI-powered dynamic pricing optimization

- Predictive inventory management

- Automated customer service (advanced chatbots)

- Personalized shopping experiences per visitor

- AI-generated product photography and videos

Prediction: By 2027, 80%+ of routine e-commerce tasks will have AI assistance options on Shopify, from writing product descriptions to analyzing performance data to optimizing ads.

2. Augmented Reality (AR) and Virtual Reality (VR)

Current State:

- 3D product models supported

- AR try-on for fashion/furniture

- Limited adoption (<5% of merchants using)

Future Potential:

- Virtual showrooms for high-ticket items

- Full virtual try-on for fashion

- AR packaging visualization

- Social commerce with AR filters

3. Voice Commerce

Current State:

- Minimal integration, mostly through third-party solutions

- Alexa/Google Assistant shopping still nascent

Future Outlook:

- Voice commerce projected to reach $40B+ by 2027

- Shopify likely to enhance voice shopping integrations

- Conversational commerce becoming standard

4. Blockchain and Web3

Current State:

- Some Shopify merchants accept cryptocurrency

- NFT integration experiments

- Limited mainstream adoption

Future Considerations:

- Decentralized commerce possibilities

- NFT-gated products and experiences

- Token-based loyalty programs

- Supply chain transparency via blockchain

Shopify’s Position: Cautiously experimenting while maintaining focus on proven technologies. Not rushing into Web3 hype but monitoring developments.

5. Live Commerce and Video Shopping

Current State:

- TikTok Shopping integration

- Instagram Shopping and Lives

- Third-party live commerce apps available

Future Growth:

- Live commerce is $500B+ market in China

- Western adoption accelerating

- Shopify likely to enhance native live commerce tools

- Integration with streaming platforms

Conclusion: The Shopify Intelligence Verdict

Overall Assessment

Shopify has solidified its position as the leading commerce platform for independent merchants, successfully navigating from startup to publicly traded company serving millions of businesses globally. The platform’s combination of ease-of-use, scalability, and ecosystem strength creates formidable competitive moats.

Key Strengths

✅ Unmatched Ecosystem: 8,000+ apps, 1,000s of themes, extensive developer community

✅ Scalability: Serves businesses from $0 to $1B+ in revenue on same core platform

✅ Reliability: Enterprise-grade infrastructure (99.99% uptime for Plus)

✅ Innovation Velocity: Regular product launches, AI integration, new commerce channels

✅ Brand Strength: “Powered by Shopify” badge signals legitimacy and trust

✅ Multi-Channel Commerce: Seamless selling across web, mobile, social, marketplaces, physical retail

Key Weaknesses

❌ App Dependency: Basic plan lacks features forcing app purchases

❌ Customization Limits: Not as flexible as open-source alternatives for complex needs

❌ Transaction Fees: Penalty for not using Shopify Payments frustrates merchants

❌ Market Saturation: Core markets (U.S., Canada) approaching saturation

❌ Economic Sensitivity: Revenue tied directly to consumer spending and merchant success

Strategic Position (2025)

Market Leader Status: Confirmed

- 28% U.S. market share and growing

- $235B+ GMV in 2023, projected $300B+ in 2025

- 4.6M+ merchants globally

- Strong brand recognition and trust

Competitive Moat: Strong and Widening

- Network effects from ecosystem

- Switching costs for established merchants

- Brand strength and trust

- Technology investments in AI, infrastructure

Growth Trajectory: Sustainable but Moderating

- Pandemic boom period over, returning to normalized growth

- International expansion provides runway

- B2B commerce offers new market opportunity

- Enterprise (Plus) segment showing strong growth

Investment Perspective

For Investors: Shopify remains a strong long-term play on the digitization of commerce globally. Post-correction valuation more reasonable than 2021 peak. Key risks: economic sensitivity, execution on international expansion, maintaining growth rates. Position: High quality, moderate risk, long-term hold.

For Merchants: Shopify is the default choice for independent e-commerce businesses. Recommended for 80%+ of businesses launching online stores. Alternatives only for edge cases (extreme customization needs, very specific requirements, existing WordPress ecosystem).

For Developers/Partners: Shopify ecosystem remains highly profitable for app developers, theme designers, and agencies. Partner program economics favorable. Growing merchant base provides expanding market opportunity.

Final VerdictShopify has won the battle to become the commerce operating system for independent businesses. The company successfully positioned itself as the “anti-Amazon,” enabling millions of merchants to build their own brands rather than becoming commoditized marketplace sellers.

The platform’s evolution from simple store builder to comprehensive commerce ecosystem—spanning payments, financing, fulfillment, marketing, and now AI-powered business tools—demonstrates strategic vision and execution capability.

For the foreseeable future (2025-2030), Shopify will remain the dominant force in powering independent e-commerce globally, continuing to grow through international expansion, B2B commerce penetration, and technology innovation.

The question is no longer “Can Shopify compete?” but rather “How large can Shopify become?”

The commerce platform war is far from over, but Shopify has established a commanding lead.

Additional Resources and External Links

Official Shopify Resources

- Shopify Official Website

- Shopify Help Center

- Shopify Community Forums

- Shopify Blog

- Shopify Investor Relations

Industry Analysis and News

- eMarketer E-commerce Reports

- Digital Commerce 360

- TechCrunch – Shopify Coverage

- The Verge – Commerce Coverage

Educational Resources

- Shopify Academy (Free Courses)

- Shopify Partners Blog

- eCommerceFuel (Community)

- Practical Ecommerce

Market Research and Data

Report Compiled: 2025

Next Update Recommended: Q2 2026

Report Classification: Public Intelligence

Sources: Company reports, analyst research, industry publications, merchant testimonials, platform dataThis intelligence report represents analysis based on publicly available information as of 2025. Projections and predictions are estimates based on current trends and should not be considered financial advice. E-commerce is dynamic—strategies and platforms evolve rapidly.

📊 Shopify Intelligence Dashboard

Powered by seoprojournal.com | Comprehensive Platform Analysis & Metrics

Active Merchants

GMV 2023

Market Share

Global Reach

🕐 Shopify Evolution Timeline

⚖️ Platform Comparison Matrix

| Platform | Ease of Use | Pricing | Scalability | Best For |

|---|---|---|---|---|

| Shopify | ⭐⭐⭐⭐⭐ | $39-$399/mo | ⭐⭐⭐⭐⭐ | Growing businesses |

| WooCommerce | ⭐⭐⭐ | Free + hosting | ⭐⭐⭐ | WordPress users |

| BigCommerce | ⭐⭐⭐⭐ | $39-$399/mo | ⭐⭐⭐⭐ | Large catalogs |

| Wix | ⭐⭐⭐⭐⭐ | $27-$159/mo | ⭐⭐⭐ | Small businesses |

| Squarespace | ⭐⭐⭐⭐ | $27-$65/mo | ⭐⭐⭐ | Design-focused |

📈 Growth Metrics (2020-2024)

📊 Detailed Analytics

Average Store Revenue

Annual revenue per Shopify store (varies by plan and industry)

Conversion Rate Average

Across all Shopify stores (industry standard)

Mobile Traffic

Percentage of Shopify traffic from mobile devices

Shopify Payments Adoption

Merchants using Shopify's native payment solution

United States

stores (50% of total merchants)

United Kingdom

stores (10.4% of total merchants)

Australia

stores (5% of total merchants)

Canada

stores (4.1% of total merchants)

Fashion & Apparel

Largest category. Avg conversion: 1.4%, AOV: $75

Health & Beauty

High loyalty. Avg conversion: 1.8%, AOV: $62

Home & Garden

Higher AOV. Avg conversion: 1.2%, AOV: $95

Food & Beverage

Subscription potential. Avg conversion: 1.5%, AOV: $58

Economic Impact

Cumulative global economic activity enabled since inception

Jobs Supported

Estimated jobs created through Shopify ecosystem

App Developer Economy

Annual revenue generated by app developers

Black Friday 2023

Sales over BFCM weekend. Peak: $4.2M/minute

🎓 Master E-commerce Intelligence

Get comprehensive guides, market analysis, and strategic insights for e-commerce success

Visit seoprojournal.com© 2025 SEO Pro Journal. Shopify intelligence dashboard for strategic analysis.

Related posts:

- Google AI Overview Impact Analysis on Major Publishers

- AI Referral Traffic: Legal and Finance Industries Dominate with 55% of New Visitor Sources

- The Reddit Intelligence Report: Comprehensive Analysis of the Front Page of the Internet

- The 2025 AI Visibility Index: Complete Market Intelligence Report(Visualization)