You’ve spent weeks perfecting your product. Your supplier is locked in. Your margins look beautiful on paper. But when you launch on Amazon, crickets.

Here’s the brutal truth: the best product in the world is worthless if customers can’t find it. And that’s where Amazon keyword research comes in—the secret weapon that separates struggling sellers from those pulling in five figures monthly.

In this guide, I’m walking you through exactly how to do keyword research for Amazon products like a pro. No fluff, no outdated tactics from 2019. Just the proven strategies and tools that actually work in 2025.

Let’s find those high-converting keywords that’ll get your products in front of buyers ready to click “Add to Cart.”

Table of Contents

ToggleWhy Amazon Keyword Research Is Different (And More Profitable)

Think Amazon keyword research is just like Google SEO? Think again.

On Google, people search for information: “how to choose wireless headphones” or “best budget laptops 2025.” They’re browsing, learning, comparing.

On Amazon, people search to buy. When someone types “wireless headphones bluetooth 5.3” into Amazon’s search bar, they have their credit card ready.

This fundamental difference changes everything. Your keyword research strategy needs to focus on buyer intent, not informational content.

The Amazon Keyword Goldmine

Here’s why mastering product keyword research is non-negotiable:

70% of Amazon shoppers never leave page 1 of search results. If your product doesn’t rank for relevant keywords, you’re invisible.

Keyword-optimized listings convert 30-50% better than generic ones. The right keywords don’t just get you found—they convince people to buy.

Backend keywords alone can boost impressions by 40% when done correctly. That’s free traffic you’re leaving on the table.

The opportunity is massive. But you need the right approach.

How Does Amazon Keyword Research Actually Work?

Let’s break down the fundamentals before we dive into tools and tactics.

Amazon keyword research is the process of identifying the exact search terms customers use when looking for products like yours. But it’s not just about finding keywords—it’s about understanding intent.

The Three Types of Amazon Keywords

1. Short-Tail Keywords (High Volume, High Competition)

These are 1-2 word phrases like “yoga mat” or “coffee maker.” Massive search volume, but brutal competition.

2. Mid-Tail Keywords (Moderate Volume, Moderate Competition)

These are 2-4 word phrases like “non-slip yoga mat” or “programmable coffee maker.” Sweet spot for most sellers.

3. Long-Tail Keywords (Lower Volume, Lower Competition)

These are 4+ word phrases like “extra thick yoga mat for bad knees” or “small coffee maker for RV.” Highly specific, highly converting.

Pro Tip: Most beginners chase short-tail keywords and wonder why they can’t rank. Smart sellers dominate long-tail keywords first, build momentum, then tackle broader terms.

Where Do Keywords Go on Amazon?

Understanding keyword placement is crucial for your keyword optimization Amazon strategy:

Title: Your most important keywords (150-200 characters)

Bullet Points: Secondary and long-tail keywords (5 bullets, ~200 characters each)

Description: Supporting keywords and variations

Backend Search Terms: Hidden keywords Amazon indexes (249 bytes)

A+ Content: Additional keyword opportunities in enhanced content

Each placement matters. Miss one, and you’re limiting your visibility. For a complete breakdown of optimization, check out our comprehensive Amazon SEO guide.

What Are the Best Amazon Keyword Research Tools for Sellers?

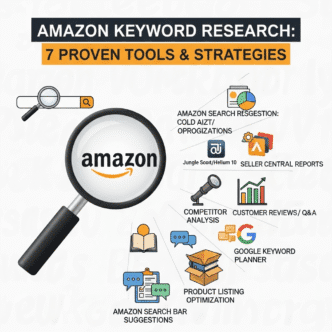

Let’s get tactical. Here are the 7 proven tools that’ll transform your Amazon keyword research game.

Tool #1: Amazon’s Own Search Bar (The Free Secret Weapon)

Before spending a dime, start here. Amazon’s autocomplete suggestions are pure gold.

How to Use It:

Type your main product category into Amazon’s search bar (don’t hit enter). Watch the dropdown suggestions appear. These are real searches from real customers, ranked by popularity.

Real Example:

Type “wireless earbuds” and you’ll see:

- wireless earbuds noise cancelling

- wireless earbuds for small ears

- wireless earbuds waterproof

- wireless earbuds with long battery life

Each suggestion reveals a specific customer need. That’s your keyword opportunity.

Pro Tip: Use this method in incognito mode to avoid personalized results. Check multiple devices to see different geographic variations.

Tool #2: Helium 10 – The All-in-One Powerhouse

Best for: Professional sellers serious about scaling

Helium 10’s Cerebro and Magnet tools are industry standards for competitive keyword analysis.

Key Features:

- Cerebro: Reverse ASIN lookup (see every keyword your competitors rank for)

- Magnet: Generate 1000+ keyword suggestions from a seed keyword

- Keyword Tracker: Monitor rankings for unlimited keywords

- Search Volume Data: Monthly search estimates for every keyword

Pricing: $29-$279/month (free plan available with limits)

Real-World Use Case:

One seller used Cerebro to analyze the top 10 yoga mat listings. They discovered “eco-friendly yoga mat cork” had 8,000 monthly searches but only 3 competitors optimizing for it. Within 60 days of targeting this keyword, they jumped from page 5 to page 1.

Access Helium 10: https://www.helium10.com

Tool #3: Jungle Scout – Best for Product Research Integration

Best for: Sellers who want keyword research tied to product validation

Jungle Scout excels at showing you not just keywords, but profitable keywords with solid demand.

Key Features:

- Keyword Scout: Search volume, PPC costs, and competition scores

- Rank Tracker: Track your products and competitors

- Opportunity Score: Identifies low-competition, high-demand keywords

- Listing Builder: Optimize your listing with discovered keywords

Pricing: $29-$129/month

Why It Stands Out:

Jungle Scout shows estimated sales data alongside keyword metrics. You’re not just finding keywords—you’re validating market demand.

Access Jungle Scout: https://www.junglescout.com

Tool #4: Sonar by Sellics – The Free Alternative

Best for: Beginners and budget-conscious sellers

Sonar offers surprising power for a completely free tool. It’s perfect for Amazon keyword research for beginners.

Key Features:

- Free keyword database: No credit card required

- Reverse ASIN lookup: See competitor keywords

- Keyword suggestions: Generate related terms

- Amazon-specific data: Not borrowed from Google

Limitations:

Less accurate search volume data and no advanced filtering. But for zero dollars, it’s incredible.

Access Sonar: https://sonar-tool.com

Tool #5: AMZScout – Chrome Extension Champion

Best for: Quick keyword research while browsing Amazon

The AMZScout Chrome extension gives you instant keyword data as you browse Amazon listings.

Key Features:

- On-page keyword analysis: See keywords for any product instantly

- Niche score: Evaluate competition level

- Product database: 500+ million products analyzed

- Keyword trends: Seasonal demand patterns

Pricing: $20-$70/month

Pro Tip: Use the Chrome extension to analyze competitor listings in real-time. Take notes on which keywords appear consistently across top sellers.

Access AMZScout: https://www.amzscout.net

Tool #6: MerchantWords – The Volume Database

Best for: Sellers who need precise search volume data

MerchantWords claims to have the largest Amazon keyword database, with real search volume estimates.

Key Features:

- 200+ million keywords: Across all Amazon marketplaces

- Search volume accuracy: Based on actual Amazon data

- Seasonal trends: Track keyword popularity over time

- International data: Research keywords for UK, DE, FR, etc.

Pricing: $30-$100/month

Access MerchantWords: https://www.merchantwords.com

Tool #7: Amazon Brand Analytics (Free for Brand Registry)

Best for: Brand-registered sellers who want official Amazon data

This is straight from the source. If you’re brand registered, you get free access to incredible keyword intelligence.

Key Features:

- Search Term Report: Top 1 million customer searches

- Search Frequency Rank: Popularity ranking for keywords

- Click Share: Which products get clicked for each keyword

- Conversion Share: Which products convert best for each keyword

How to Access:

Seller Central → Brand Analytics (requires Brand Registry enrollment)

Pro Tip: The Search Term Report is updated weekly. Check it every Monday to spot trending keywords before competitors do. Learn more about protecting your rankings through proper account health management.

Amazon Keyword Research Tools Comparison Table

| Tool | Best For | Price Range | Key Strength | Search Volume Accuracy |

|---|---|---|---|---|

| Amazon Search Bar | Everyone | Free | Real customer intent | N/A |

| Helium 10 | Advanced sellers | $29-$279/mo | Comprehensive features | ⭐⭐⭐⭐⭐ |

| Jungle Scout | Product validation | $29-$129/mo | Sales estimates | ⭐⭐⭐⭐ |

| Sonar | Beginners | Free | Cost-effective | ⭐⭐⭐ |

| AMZScout | Quick research | $20-$70/mo | Chrome extension | ⭐⭐⭐⭐ |

| MerchantWords | Volume data | $30-$100/mo | Largest database | ⭐⭐⭐⭐⭐ |

| Brand Analytics | Brand Registry | Free | Official Amazon data | ⭐⭐⭐⭐⭐ |

Step-by-Step Amazon Keyword Research Guide for Beginners

Ready to find your winning keywords? Follow this proven process.

Step 1: Start With Seed Keywords

Begin with 3-5 obvious product descriptors. For a bamboo cutting board, your seeds might be:

- cutting board

- bamboo board

- chopping board

- kitchen board

- wood cutting board

These aren’t your final keywords—they’re starting points for deeper research.

Step 2: Use Amazon Autocomplete for Customer Language

Type each seed keyword into Amazon’s search bar and note all suggestions. Pay special attention to:

Feature-based keywords: “cutting board with juice groove”

Problem-solving keywords: “cutting board that won’t slip”

Size/specification keywords: “large cutting board 18×12”

Use-case keywords: “cutting board for meat”

Customers tell you exactly what they want. Listen.

Step 3: Reverse Engineer Your Top Competitors

Find the top 10 listings in your category. Use a tool like Cerebro (Helium 10) or Sonar to extract every keyword they rank for.

What to Look For:

Keywords that appear in 5+ competitor listings (these are category essentials)

Keywords where only 1-2 competitors rank (opportunity gaps)

Long-tail keywords with decent volume but low competition

Step 4: Analyze Search Volume vs. Competition

Now you have a huge list. Time to prioritize using the keyword research strategy pros use:

High Priority: 2,000-20,000 monthly searches + low competition

Medium Priority: 1,000-2,000 monthly searches + any competition level

Low Priority: Under 1,000 monthly searches (unless incredibly specific and relevant)

Use your tool’s competition metrics or manually check how many results appear when you search that keyword on Amazon.

Step 5: Validate Commercial Intent

Not all keywords convert equally. Prioritize keywords that indicate buying intent:

Strong Intent: “buy bamboo cutting board,” “best bamboo cutting board”

Medium Intent: “bamboo cutting board reviews,” “large bamboo cutting board”

Weak Intent: “how to clean bamboo cutting board,” “bamboo cutting board care”

Focus 80% of your effort on strong and medium intent keywords. For more on conversion optimization, see our guide on improving Amazon conversion rates.

Step 6: Organize Keywords by Placement

Create a spreadsheet with columns for:

Title Keywords: Your top 5-7 highest-value keywords

Bullet Point Keywords: Secondary keywords and variations (20-30)

Backend Keywords: Synonyms, misspellings, related terms not in visible content (30-40)

Description Keywords: Supporting long-tail keywords (10-15)

This organization makes listing creation infinitely easier.

Step 7: Check Seasonal Trends

Use tools like Helium 10’s Trendster or Google Trends to identify seasonal patterns.

Example: “Beach towel” peaks May-July. “Space heater” peaks November-February.

Launch seasonal products 60-90 days before peak season to build ranking momentum.

Pro Tip: Set calendar reminders to update your backend keywords seasonally. Swap in trending variations as customer search behavior changes.

What Are the Best Free Amazon Keyword Research Methods?

Don’t have budget for premium tools yet? These free Amazon keyword research methods still pack serious punch.

Method #1: The Alphabet Soup Technique

Type your seed keyword + each letter of the alphabet into Amazon’s search bar:

- bamboo cutting board a (autocomplete suggestions)

- bamboo cutting board b (autocomplete suggestions)

- bamboo cutting board c (autocomplete suggestions)

Continue through Z. You’ll uncover dozens of keyword variations customers actually use.

Method #2: Competitor Review Mining

Read the reviews of your top 3 competitors. Customers reveal exactly what keywords they searched and what features matter most.

Look for phrases like:

“I was looking for a cutting board that…”

“I needed something that would…”

“Finally found a board with…”

These are pure gold keyword phrases.

Method #3: Amazon’s “Customers Also Searched For” Section

When viewing any product, scroll down to see what other search terms Amazon associates with that product.

Click through several related products and compile all the suggested searches. This is free keyword intelligence directly from Amazon’s algorithm.

Method #4: Google Keyword Planner (With a Twist)

While Google data isn’t Amazon-specific, it reveals related keywords you might miss.

Search your seed keywords in Google Keyword Planner, but add filters like “buy,” “best,” “review” to find commercial intent terms.

Cross-reference these with Amazon search to validate they’re used on the platform.

Method #5: The Customer Question Goldmine

Check the “Customer Questions & Answers” section on competitor listings. Questions reveal:

Confusion points: Keywords that need clarification in your listing

Feature desires: Specifications customers care about

Use cases: Applications you should mention in bullets

Turn these insights into targeted long-tail keywords.

Pro Tip: Amazon’s “Frequently Bought Together” section reveals complementary products. Their keywords might apply to your product too, especially for bundle opportunities.

Advanced Amazon Keyword Research Techniques for 2025

Ready to level up? These advanced tactics separate six-figure sellers from everyone else.

Technique #1: AI-Powered Keyword Discovery

In 2025, smart sellers are using AI tools to uncover keyword opportunities humans miss.

ChatGPT Prompt for Keywords:

“I’m selling a [product]. Generate 50 long-tail keyword variations that a customer with [specific pain point] would search for on Amazon. Focus on buying intent keywords.”

Claude Prompt for Keywords:

“Analyze these 10 competitor ASINs: [list]. What keyword gaps exist that I could target? Prioritize keywords with commercial intent and lower competition.”

AI won’t replace dedicated tools, but it’s excellent for brainstorming and finding uncommon keyword angles.

Technique #2: The Listing Hijack Strategy

Find successful listings in adjacent categories that could apply to your product.

Example: Selling a waterproof phone case? Check keywords from:

- Waterproof cameras

- Waterproof watches

- Beach bags

- Swim gear

Cross-category keyword borrowing can reveal untapped search terms your direct competitors haven’t considered.

Technique #3: Misspelling and Synonym Stacking

Amazon’s algorithm is smart, but not perfect. Backend keywords should include:

Common misspellings: “blutooth” instead of “bluetooth”

British vs. American spelling: “colour” vs. “color”

Abbreviations: “BT” for “bluetooth,” “NC” for “noise cancelling”

Synonyms: “earbuds,” “earphones,” “ear buds,” “in-ear headphones”

These variations don’t clutter your visible content but capture additional searches.

Technique #4: The Search Term Performance Report

If you’re running PPC campaigns (and you should be), your Search Term Report is a keyword goldmine.

How to Access:

Seller Central → Advertising → Campaign Manager → Select Campaign → Search Term Report

This report shows exactly what customers searched before clicking your ad. It reveals:

Converting keywords: Terms that led to sales (add these everywhere)

High-impression, low-click keywords: Terms you’re ranking for but not converting (improve your listing)

Wasted spend keywords: Irrelevant terms (add as negative keywords)

Review this report weekly and continuously refine your keyword strategy. For comprehensive PPC tactics, explore our Amazon PPC strategy guide.

Technique #5: International Keyword Expansion

Amazon operates in 20+ countries. Your product might dominate in markets with less competition.

Top Opportunities:

Canada (English, low competition vs. US)

UK (English, distinct search patterns)

Germany (highest buying power in EU)

Australia (English, growing market)

Use Helium 10 or Jungle Scout’s international features to research keywords in these markets. The same product that struggles on page 5 in the US might own page 1 in Canada.

Pro Tip: Don’t just translate keywords. Use native speakers or tools like Amazon.co.uk’s search bar to find how locals actually search. “Soccer” in the US is “football” in the UK—different keywords, same product.

How Do You Optimize Backend Keywords on Amazon?

Backend keywords Amazon offers 249 bytes of hidden SEO power. Here’s how to maximize every character.

Backend Keyword Best Practices

Rule #1: Don’t Repeat Anything in Visible Content

If “wireless earbuds” appears in your title, don’t waste backend space on it. Amazon already knows.

Rule #2: Use Spaces, Not Commas

“bluetooth wireless earbuds” (3 separate keywords indexed)

“bluetooth,wireless,earbuds” (wastes 2 characters on commas)

Rule #3: No Punctuation or Capitalization Needed

Amazon ignores these anyway. Save the characters.

Rule #4: Include Logical Misspellings

“blutooth,” “wirless,” “headfones”—yes, people misspell these.

Rule #5: Add Synonyms and Alternative Terms

If your title says “water bottle,” backend should have “hydration flask,” “sports bottle,” “insulated tumbler”

What NOT to Put in Backend Keywords

❌ Brand names you don’t own (violation of Amazon TOS)

❌ ASINs or product identifiers

❌ Subjective claims (“best,” “amazing,” “perfect”)

❌ Anything offensive or inappropriate

❌ Keywords already in your title, bullets, or description

Backend Keyword Example

Product: Wireless Bluetooth Earbuds

Title includes: wireless earbuds, bluetooth 5.3, noise cancelling

Backend should include: “cordless earbuds earphones in ear headphones true wireless buds pods music headset sports running workout gym airpods alternative blutooth wirless ipod iphone android compatible sweatproof waterproof”

That’s 247 bytes of pure keyword value.

Pro Tip: Update your backend keywords every 60-90 days based on your Search Term Report. Seasonal trends change, new competitors emerge, and customer language evolves.

What Mistakes Kill Your Amazon Keyword Research?

Let’s talk about what not to do. These errors cost sellers thousands in lost sales.

Mistake #1: Keyword Stuffing Your Title

Bad Title: “Wireless Earbuds Bluetooth Headphones Earphones Ear Buds Pods Music Headset Sports Running Workout Gym”

This looks spammy, hurts click-through rate, and actually damages your ranking.

Good Title: “ProSound Wireless Earbuds, Bluetooth 5.3 Noise Cancelling Headphones with 48H Playtime, IPX7 Waterproof”

Clear, readable, keyword-rich without spam.

Mistake #2: Ignoring Long-Tail Keywords

Beginners chase “headphones” (1 million monthly searches, impossible to rank). Smart sellers target “bluetooth headphones for small ears women” (5,000 searches, page 1 achievable).

Long-tail keywords convert 2-3x better because they match specific customer intent.

Mistake #3: Using Only Tool Data

Tools are incredible, but they’re not perfect. Amazon search terms change daily. Always validate tool suggestions by:

Actually searching the keyword on Amazon

Checking if results match your product type

Seeing what actually ranks (are they even your competition?)

Mistake #4: Set-It-and-Forget-It Keywords

Your initial keyword optimization Amazon is just the beginning. Top sellers:

Review keyword performance monthly

Update backend keywords based on PPC data

Seasonal rotate keywords (summer keywords in winter won’t help)

Test new variations continuously

Amazon is dynamic. Your keyword strategy must be too.

Mistake #5: Copying Competitors Exactly

Learning from competitors? Smart. Copying them word-for-word? Dumb.

Amazon values uniqueness. Plus, your competitors might not have optimized correctly. Do your own research and find gaps they missed.

Pro Tip: If 10 competitors all use the same keyword structure, that keyword is probably saturated. Look for the phrases only 1-2 competitors use—those are your ranking opportunities.

Real-World Case Study: $0 to $15K/Month Through Strategic Keyword Research

Let me share how proper product keyword research transformed one seller’s business.

The Product: Stainless Steel Water Bottle

Starting Position (Month 1):

- Daily sales: 2-3 units

- Main keyword: “water bottle” (ranking position: not in top 100)

- Total monthly revenue: $600

The Problem

Generic keywords, no differentiation, invisible in search results.

The Strategy

Phase 1: Long-Tail Domination

Instead of fighting for “water bottle,” they targeted:

- “insulated water bottle 32 oz”

- “leak proof water bottle for gym”

- “stainless steel water bottle dishwasher safe”

- “cold water bottle 24 hours”

These keywords had 1,000-3,000 monthly searches each, but minimal competition.

Phase 2: Backend Optimization

Backend keywords included:

- Misspellings: “insulated watter bottle”

- Synonyms: “hydration flask,” “thermos bottle,” “sports bottle”

- Use cases: “hiking water container,” “gym hydration”

Phase 3: PPC Precision

Ran targeted campaigns for each long-tail keyword at $0.50-0.80 CPC (cheap compared to $2-3 for “water bottle”).

The Results (Month 6)

Daily sales: 18-22 units

Main keywords ranking:

- “insulated water bottle 32 oz” – Position 3

- “leak proof water bottle for gym” – Position 2

- water bottle” – Position 47 (improved from not ranking)

Monthly revenue: $15,400

Key Takeaway: They didn’t chase the biggest keywords first. They dominated specific niches, built momentum, then naturally climbed broader terms. That’s the power of strategic keyword research.

How Often Should You Update Your Amazon Keywords?

Quick Answer: Review monthly, update quarterly, or immediately when data demands it.

Monthly Review Checklist

✅ Check Search Term Report for new converting keywords

✅ Monitor competitor listings for keyword changes

✅ Review seasonal trends (prepare for upcoming seasons)

✅ Analyze ranking changes for target keywords

When to Update Immediately

Major ranking drop: Your keywords might be outdated

New competitor enters: They might be targeting better keywords

Seasonal shift: Customer search behavior changes

Product launch: Start with one set, optimize based on performance

PPC reveals winners: If a keyword crushes it in ads, add it everywhere

Keyword research isn’t a one-time task. It’s an ongoing optimization process that compounds over time. The more you refine, the better you rank.

For ongoing optimization strategies, check our complete guide on Amazon listing optimization.

Amazon Keyword Research Tools: Free vs. Paid Decision Matrix

Still wondering if you should invest in paid tools? Here’s how to decide.

Choose Free Tools If:

✅ You’re selling 1-3 products total

✅ You have more time than budget

✅ You’re validating product ideas before investing

✅ Your niche has low competition

Invest in Paid Tools If:

✅ You’re managing 5+ products

✅ You need accurate search volume data

✅ You want to track competitor changes automatically

✅ Time is more valuable than money

✅ You’re running PPC campaigns (tools pay for themselves in wasted ad savings)

My Recommendation: Start with free methods for your first 1-2 months. Once you’re making $2,000+/month, invest in Helium 10 or Jungle Scout. The ROI is immediate.

Trending AI & Amazon SEO Integration in 2025

The Amazon keyword research landscape is evolving with AI integration. Here’s what’s changing.

AI-Powered Listing Optimization

Tools like Helium 10’s Listing Analyzer now use AI to:

Suggest keyword placement optimization

Predict which keywords will trend based on seasonal patterns

Generate variations of high-performing keywords

Identify semantic keyword opportunities

ChatGPT for Keyword Brainstorming

Smart sellers are using AI prompts like:

“Generate 30 unique long-tail keywords for [product] targeting [specific customer pain point]. Focus on high commercial intent.”

“Analyze these 5 competitor titles and suggest keyword gaps I can exploit: [titles]”

AI won’t replace manual research, but it accelerates ideation and uncovers angles you might miss.

Amazon’s NLP Evolution

Amazon’s A10 algorithm now understands natural language better than ever. This means:

Conversational keywords work: “bluetooth headphones good for small ears”

Semantic matching improved: Searching “earbuds” might show “wireless headphones

Context matters more: Keywords in logical, readable sentences rank better than stuffed lists

The future of Amazon search terms is conversational. Optimize for humans first, algorithms second.

Final Thoughts: Your Amazon Keyword Research Action Plan

You now have everything you need for world-class Amazon keyword research.

Here’s your immediate action plan:

This Week:

- Start with Amazon’s autocomplete for your top 3 products

- Sign up for one free tool (Sonar recommended)

- Analyze your top 5 competitors’ listings manually

This Month:

- Complete full keyword research for each product

- Update all titles and bullets with optimized keywords

- Fill backend keywords strategically

- Launch PPC campaigns targeting your best long-tail keywords

Ongoing:

- Review Search Term Reports weekly

- Update backend keywords monthly based on performance

- Track competitor changes and adapt

- Test new keyword variations in PPC before adding to listings

The sellers who dominate Amazon don’t have better products—they have better keyword optimization Amazon strategies.

Your products deserve to be found. Now you know exactly how to make that happen.

Ready to learn even more? Dive into our complete Amazon SEO guide for advanced ranking tactics, or explore our guide on getting Amazon reviews to accelerate your launch.

Frequently Asked Questions

Q: How long does it take to see results from keyword optimization?

You’ll typically see ranking improvements within 1-2 weeks of optimizing your listing, especially for long-tail keywords. Broader, competitive keywords may take 4-8 weeks. Running PPC alongside optimization accelerates results dramatically.

Q: Can I rank for keywords not in my title or bullets?

Yes, through backend keywords. However, keywords in visible content (title, bullets, description) carry more weight. Backend keywords work best for synonyms, misspellings, and variations that don’t fit naturally in your listing.

Q: How many keywords should I target per product?

Focus on 5-7 primary keywords for your title, 15-25 secondary keywords across bullets and description, and 30-50 backend keywords. Quality over quantity—better to rank well for 20 relevant keywords than poorly for 100.

Q: Should I use the same keywords as my main competitor?

Use them as a starting point, but don’t copy exactly. Identify gaps they’re missing and unique angles you can own. Ranking for different (but relevant) keywords reduces direct competition.

Q: What’s the biggest keyword research mistake new sellers make?

Chasing high-volume, competitive keywords instead of starting with achievable long-tail keywords. Build momentum with easier wins, then tackle broader terms.

Q: Do I need different keywords for different Amazon marketplaces?

Absolutely. Customers in different countries use different search terms, even for English-speaking markets. Always research keywords specifically for each marketplace you sell in.

Q: How do I know if a keyword is too competitive?

Check how many results appear when you search it, and analyze the top 10 listings’ review counts. If the first page is dominated by products with 5,000+ reviews and you have under 100, that keyword is likely too competitive to tackle immediately.

Q: Can I change my keywords after launch without hurting my ranking?

Yes, you can and should update keywords based on performance data. Changes to visible content (title, bullets) might cause temporary ranking fluctuations, but backend keyword changes have minimal impact. Make changes based on data, not guesses.